THE ELEPHANT IN THE ROOM

You can’t miss it… the metaphorical elephant in the room. That outsized awkward issue that we pretend not to see. The elephant in this case – speaking metaphorically of course – is an orange-colored version of Darth Vader intent on crushing a much smaller and presumably, weaker adversary.

Too strong? Perhaps, but Canadians cannot ignore what could be an existential threat to our domestic economy. President Trump’s threat to impose 25% tariffs on Canadian exports coming into the US represents a direct assault on 30% of Canada’s GDP.

Certainly, America’s approach to “getting the point across” involves bold statements and fireworks, while Canadians prefer decorum and apologizing for the interruption even when we are not interrupting.

The issue is whether the tariff threat is a negotiating tactic to gain leverage leading up to a re-negotiation of the USMCA, or an existential threat from an incoming administration hell bent on annexing a neighbor by demolishing its economy. What we do know is that surviving this eclectic range of outcomes will require more than saying “I’m sorry!”

NEXT STEPS

The first step is to understand one’s adversary. We need to recognize that the MAGA movement is protectionist philosophy back stopped by a transaction-based administration. The trick is to ferret out the end goal which, make no mistake, is not border security.

What Trump “really-really” wants (with apologies to the Spice Girls), is to deliver on his campaign promises to deliver aggressive tax cuts without expanding the budget deficit. He believes Tariffs will generate sufficient revenue to offset any shortfall from his administration’s aggressive tax policies. If that is the end goal, then Tariffs are all but certain.

That scenario will result in a tit-for-tat trade war. Canada will put in place countervailing Tariffs on US imports and may tax and / or limit exports of minerals like nickel, cobalt, copper, lithium, and rare earth elements. Raw materials where Canada has abundant supply, that are critically important to the US and are no longer available from China.

We must acknowledge the possibility, however unlikely, that Trump wants to annex Canada. His rhetoric about getting “rid of that artificially drawn line” implies that Trump wants to make his mark on history by annexing Canada and fulfilling President James K. Polk’s mid-19th century concept of “manifest destiny.” The idea that the US was divinely ordained to rule the entire North American continent.

Trump’s grandstanding is a significant departure from America’s vision of national self-determination and mutual defense. If we accept as true Trump’s posturing, then we must also acknowledge that he is positioning his second administration as one of aggressive expansionism, something we haven’t seen in Washington since the Spanish-American War in 1898.

The only way Trump can annex Canada is to hobble the Canadian way of life by applying maximum economic pressure. The best way to resist a worst-case scenario is to negotiate from a position of strength which means that whoever wins the next Federal election must lower Canadian tax rates or suffer a brain drain to the US. Without a competitive tax system, we are playing into the hands of the US administration.

The Bank of Canada (BoC) must continue to lower interest rates to bolster industries that are not reliant on exports. Lower rates will have a negative impact on the Loonie which we think could decline to US 60 cents by the end of 2025. Depending on where the Canadian government intends to apply countervailing Tariffs could push up the Canadian inflation rate as imports would be more expensive.

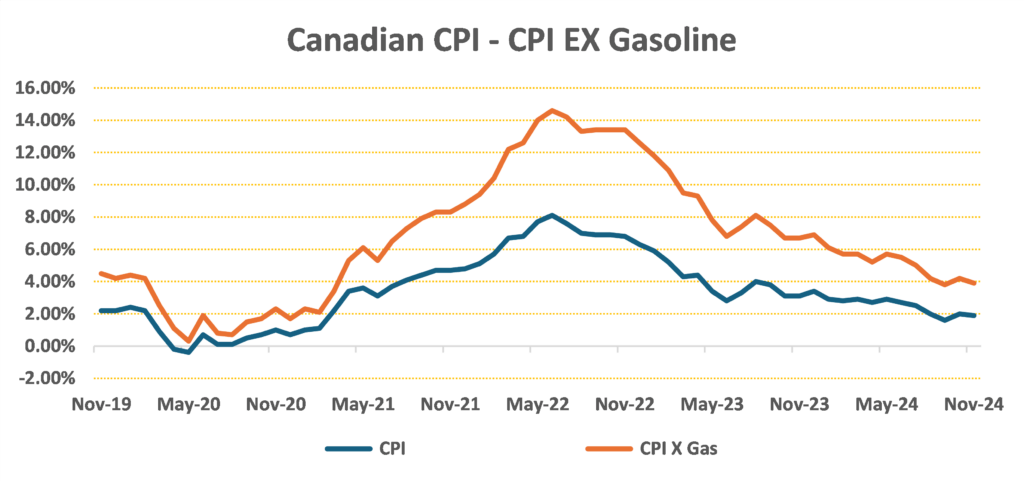

However, there are silver linings. A slowing domestic economy will reduce inflation pressures which have been on a better path than in other parts of the world. If you take out rising mortgage interest costs (a direct result of earlier interest rate increases), the Canadian consumer price index (CPI) has been at or below the BoC’s 2% inflation target for all of 2024. Notably, CPI ex-mortgage interest has been trending around 1.4% which is why the Bank of Canada has been able to ease monetary policy more quickly than other G-7 members. Note the BoC has already cut its overnight lending rate by 175 basis points since June 2024.

The inflationary impact from countervailing Tariffs should be muted because most of what Canadians consume is not imported. Imported consumer goods (excluding autos) represent less than 10% of total household spending, and disinflationary pressures from a broadly softer Canadian economy are larger than the inflationary impact that would result from a weaker currency.

Then there are the psychological factors that come into play during a trade war. We suspect that Canadian consumers will shun American products and seek out Canadian made alternatives. Snowbirds will begin re-thinking their trips to the sunny south, especially if the Loonie declines as expected. These conditions will weigh on US revenues.

We are also mindful of the differences in the trajectory of the North American economies. A slowing Canadian economy will allow the BoC to continue cutting interest rates more aggressively than the U.S. Federal Reserve (FED), reflecting the underperformance (dating back to the 1960s) in per-capita GDP growth over the last five years, and a more significant softening within the Canadian labor market.

According to Royal Bank, “the situation in the United States is very different with a resilient economy driven in large part by an unusually large government budget deficit for this point in the economic cycle, reduced interest rate sensitivity, and strong productivity support that is keeping economic growth positive but also inflation higher.”

In absolute terms, these factors are meaningful, particularly when compared to the Canadian experience where interest rate sensitivity is a considerable issue. Just think about the potential impact from the tsunami of mortgage renewals that will occur in 2025.

IMMIGRATION TAILWINDS

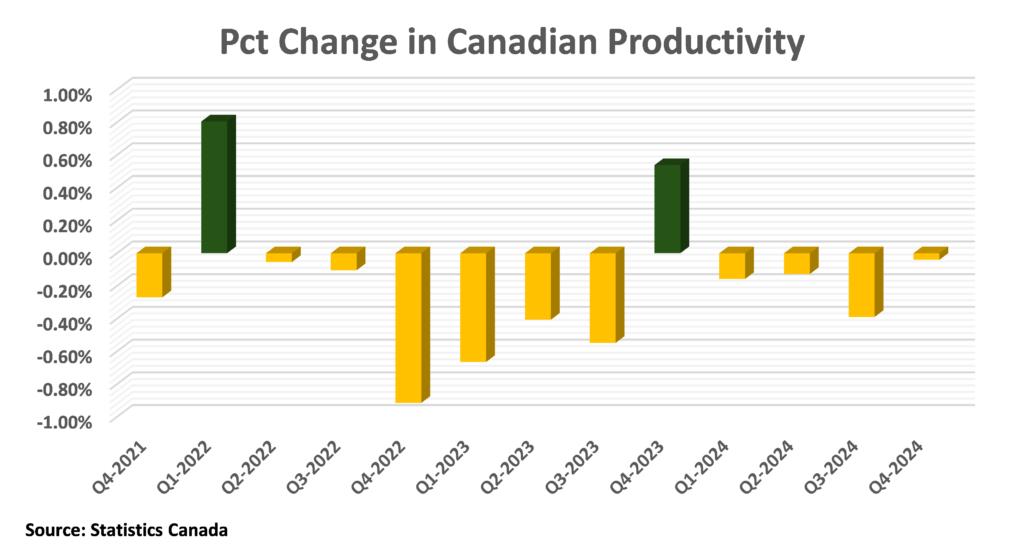

Canadian immigration has also been a tailwind as population growth is up 10% since 2019. That open-immigration policy prevented outright declines in Canadian GDP, but on a per-capita basis, output has been falling like it historically would during a recession.

Moreover, the support from population growth is about to make a sharp U-turn. The Federal government’s plans to limit new arrivals are expected to wipe out all previously expected population growth in years ahead. While the final impact on population is yet to be known, the direction will be lower, turning demographics from a tailwind to a headwind.

The offset to dwindling population growth would be a bump up in productivity. Hopefully, GDP growth on a per-capita basis will turn the corner by mid-2025. Lower interest rates take time to work their way through the system. Household debt levels are expected to rise in the year ahead as fixed-rate mortgages, dating back to the ultra-low borrowing costs days of the pandemic, continue to renew at higher rates. Hopefully, that mortgage renewal wave will be manageable if the labor market remains resilient.

While the Canadian labor market slowdown is likely not over yet, we expect the unemployment rate to peak at a level slightly below 7% and begin to edge lower in the second half of 2025.

To that point, we are seeing some green shoots as Canada’s most recent employment data came in better than expected. The Canadian economy produced 91,000 new jobs for the month of December 2024 and of that total, 56,000 were new full-time positions.

TARIFF THREATS WILL CONTINUE

We should assume, regardless how Canada deals with the initial Tariff squeeze, that Trump will use Tariffs as a negotiating tool throughout his Presidency. These threats must be factored into Canada’s growth prospects for the next four years.

The threat of a 25% across the board Tariffs on products from Canada and Mexico would seem to be unrealistic as they would make the North American manufacturing ecosystem uncompetitive with offshore supply chains.

If the Tariff threat is a negotiation strategy tied to border security, then we would expect Canada and the US to arrive at a reasonable compromise. If the threats are part of a larger objective – annexation of Canada, revenue enhancement to offset US tax cuts or to encourage onshoring – then all bets are off.

Regardless of the outcome, this will not be the last time US Tariffs will be used as negotiating levers. There is ample evidence that Tariffs are in Trump’s wheelhouse, and we would expect periodically the US government will employ targeted measures on specific products and industries like the 2018 Tariffs on Canadian steel and aluminum products. This approach was used to address external grievances in the first Trump administration and despite the questionable merits of this strategy, the risks exist and will likely weigh on already underperforming Canadian business investment.

That said, the bigger issue for Canada’s domestic economy is our productivity gap. Canada’s per-person output significantly trails other G-7 economies and continues to be hampered by a shortfall in business investment.

Moving forward, the risk is that weak levels of business investment will persist. Lower interest rates will help lower funding costs, but the threat of trade disruptions adds to uncertainty about future project returns.

Just remember, that Canadians are resilient, and we will overcome.

CANADA’S MISLEADING DEBT BURDEN

Discussing Canada’s debt cliff is a lot like the country’s maple syrup industry; sticky, sweet and parsed by a sugar high from over-indulgence.

As the second-largest country in the world by landmass, Canada has the resources to be a global powerhouse. But our debt per capita (the amount of debt divided by the population) makes us look like a lumberjack hunkered down in a cozy cabin feeding on a mountain of poutine.

That conflicts with Prime Minister Trudeau’s position that “Canada actually has the strongest fiscal position of any of the world’s advanced economies,” which we believe is inaccurate.

Trudeau’s position is supported by the International Monetary Fund (IMF) that, in its most recent report, noted that Canada has the lowest level of net debt (as a share of its economy) among the G-7 countries which include Germany, Italy, Japan, France, the United Kingdom and the United States.

However, according to the Fraser Institute, “Canada’s indebtedness is flawed because it assumes the country’s financial assets can be used to offset debt and therefore subtracts these assets from total government debt. This is a significant problem because Canada’s financial assets include the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), which were valued at a combined $717 billion at the end of 2023.”

The finance department’s (read: Cynthia Freeland’s Spring 2024 budget) slight-of-hand “net debt” tactic implies that the pension assets of Canadian workers are part of the government’s balance sheet. That, by definition, implies that pension assets can be used to pay off the national debt.

In fairness, Canada is not the only country to use pension assets in this game of fiscal hocus-pocus. The US government applies similar net debt calculations when reporting their national debt. The difference is that Social Security, Medicare and Medicaid assets are legislated as part of the Treasury’s balance sheet.

To which we say, vive-la-difference! The fact that Canadian pension assets have been and continue to be reported separately as a fund managed by CPP Investments is fiscally prudent. As are the sustainability assessments performed by independent actuaries guided by the fund’s principal objective; to provide retirement income for Canadians, not as a piggy bank to backstop pet projects.

So, why should we care that it is misleading to use net debt to compare Canada’s indebtedness to other countries?

The answer is because misleading information rationalizes bad decisions. Case in point, the Liberals justified overshooting its own deficit target by suggesting that “Canada’s economy is the envy of the G-7.” When in fact, Canada’s debt-to-GDP ratio is 107%, according to the IMF, which is significantly higher than the government’s claim of 40%.

Canada’s total obligations, including personal and corporate debt, is around $8.85 trillion. In 2024, Canada’s federal debt interest costs are expected to be over $54 billion, which is the same as the government’s revenue from the Goods and Services Tax (GST). Advocating a GST holiday using misleading information is the definition of political gimmickry (Cynthia Freeland’s words) and masks the seriousness of Canada’s debt cliff.

On that point, the Fraser Institute compiled a study that compared Canada’s total government debt (i.e., government liabilities not offset by any financial assets) with 32 advanced economies worldwide. The study found that Canada ranked 26th in terms of total debt relative to the size of the country’s economy. “Clearly, despite the government’s claim that Canada has the “strongest fiscal position in the world, the evidence shows Canada is among the most indebted advanced economies and that fellow G-7 countries Germany and the United Kingdom have lower total debt than Canada,” notes the study’s authors.

Government debt has immediate and long-term consequences. In the short term, governments must pay debt interest on their borrowing. As mentioned, Federally mandated, debt interest costs are projected to surpass $54 billion in 2025. At the provincial level, Canadian taxpayers are expected to collectively spend another $37.1 billion on government debt interest costs.

Longer term, future generations of Canadians must repay the debt through a combination of tax increases and/or a reduction in services. Despite having no say over current government decisions, in the coming years and decades Canadians under the age of 18 will likely repay most of today’s debt accumulation.

Prime Minister Trudeau’s assertion that Canada has the “strongest fiscal position” of any advanced economy is incorrect. We are, unfortunately, one of the most indebted advanced economies in the world, which is why it’s important for policymakers to root their statements in fact rather than conjecture. The first step in any recovery is to admit you have a problem.

A PRIMER ON REVERSE MORTGAGES

Does a reverse mortgage allow you to unlock a hidden treasure without having to wrestle a map from an unwilling pirate? With all due respect to a good metaphor, the treasure in this case is your principal residence and the map is the reverse mortgage. The challenge is that the map is fraught with twists and turns that for the financially illiterate can lead to a minefield of adversity.

Not surprisingly, several clients have asked us to weigh in on the benefits and pitfalls of reverse mortgages. And make no mistake, there are significant pros and cons. Depending on the individual circumstances, a reverse mortgage can be the financial equivalent of a free lunch or the foundation underpinning an existential threat to one’s estate plan.

As portfolio managers, we are guided by fiduciary standards that require us to always act in the best interest of our clients. This gives us a unique perspective to pull back the covers and set out the realities – good and bad – that dot the reverse mortgage landscape.

BACKGROUND

A reverse mortgage can be either a “recourse” or “non-recourse” loan. The most common reverse mortgage in Canada is the recourse loan, where the borrower is responsible for any shortfall in the repayment of the loan. For example, if your home is underwater (i.e., you owe more than what the property is worth), your estate is responsible for any shortfall in the amount of proceeds from the sale of the home and the remaining balance on the reverse mortgage.

A non-recourse loan protects the borrower’s estate because the lender can only recover the collateral supporting the loan in the event of default. If the collateral doesn’t entirely cover the balance owed, the lender cannot seek legal action to recover the difference or pursue other assets to settle the shortfall. Which is to say, if you were in default for the mortgage payment on a non-recourse loan, the lender can only recover the amount from the sale of the collateral (i.e., the principal residence) attached to the mortgage. The downside is that non-recourse loans tend to be more expensive (i.e., higher interest rate).

To provide a simple illustration, consider the following example. Suppose your principal residence is valued at $1 million. Further, we will assume that you do not currently have any outstanding mortgage on the property.

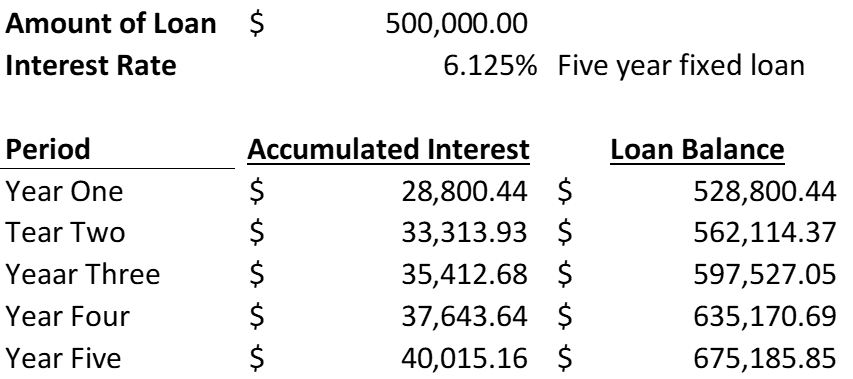

The lender might offer a non-recourse reverse mortgage of say $500,000. Assuming a five-year fixed rate of 6.125%, the mortgage balance at the end of a five-year term would be $675,185.85 as shown in the accompanying table.

Remember that you are not making any payments on a reverse mortgage. If at the end of the term, let’s assume that the real estate market collapsed, and your property was worth only $600,000. The lender can only recover the $600,000 value of your property and would have to eat the remaining outstanding balance.

With the more common recourse loan, you or your estate, would be required to cover the shortfall, which is the above example would be $75,185.85.

That’s not to say that walking away from a non-recourse mortgage is straightforward. It will still impact on your credit score and future borrowing ability.

Obviously, the non-recourse loan is less risky for the borrower but carries greater risk for the lender. Which is why these types of loans are rarely offered in Canada. Assuming you can get a non-recourse reverse mortgage, the lender will limit the amount of exposure by reducing the percentage of loan to collateral amount and will likely charge a higher interest rate. For example, as cited in the previous example, a lender might offer a reverse mortgage up to 40% of the value of the principal residence rather than say 50% of the value for a recourse loan.

BENEFITS AND PITFALLS

Now that we understand the differences between a recourse and non-recourse loan, we can delve into the pros and cons associated with a reverse mortgage. Simply stated, a reverse mortgage is a financial product designed to allow homeowners aged 62 or older to access the equity in their homes without having to sell or move out.

While this type of loan can offer several advantages, it also comes with significant drawbacks that potential borrowers need to carefully consider.

THE PROS OF REVERSE MORTGAGES

1. Access to Extra Cash

This is the primary benefit of the reverse mortgage because it allows a homeowner the ability to access the equity in a home without selling it. From the marketing literature, homeowners can call up much-needed funds to manage financial circumstances such as living expenses, medical bills, not to mention a host of unexpected expenses. The loan is repaid only when the homeowner sells the house, moves out, or passes away, allowing seniors to continue living in their homes while enjoying additional financial security.

2. No Monthly Mortgage Payments

Unlike traditional mortgages, a reverse mortgage does not require monthly payments. The loan is repaid when the homeowner moves, sells the house, or dies. This feature can be particularly appealing for retirees who are struggling to meet monthly financial obligations on a fixed income. Without the monthly expense of mortgage payments, the homeowner can free up cash that can be used for other essential expenses or to enjoy retirement without the worry of mortgage debt.

3. Non-Recourse Loan

Assuming one can get a non-recourse reverse mortgage, the homeowner or their heirs will never owe more than the value of the home when the loan is due. This is especially beneficial in case the housing market declines, and the value of the principal residence declines. Even if the home is worth less than the loan balance at the time of repayment, the lender cannot come after the homeowner’s other assets to make up the difference.

4. Homeownership Retained

With a reverse mortgage, the homeowner continues to own the home, maintaining control over their property. This means they can live in the home for as long as they wish. Assuming, of course, the homeowners meet certain requirements, such as maintaining the home and paying property taxes and insurance.

5. Tax-Free Loan Proceeds

The money received from a reverse mortgage is generally not considered taxable income, which can be a significant benefit to those who need to supplement their retirement income.

THE CONS OF REVERSE MORTGAGES

1. Accumulating Loan Balance

While the absence of monthly payments may seem attractive, the loan balance on a reverse mortgage grows as time passes due to the added interest and fees (see previous table). The longer the homeowner stays in the home, the larger the debt becomes. This can create a situation where the equity in the home is gradually eroded, potentially leaving little for the homeowner’s heirs after the property is sold to repay the loan.

2. Costly Fees

Reverse mortgages come with a variety of fees, including origination fees, closing costs, insurance premiums, and servicing fees. Note the interest rate used in the previous table, which is the current five-year fixed rate provided by one lender. The total set up costs can be significant, especially when compared to a traditional mortgage. Some fees are paid upfront, while others may be rolled into the loan balance. These expenses can further reduce the amount of equity in the home, leaving less for the homeowner or their heirs.

3. Impact on Heirs

A reverse mortgage can complicate inheritance plans. Since the loan is repaid when the homeowner sells the home, moves, or dies, the heirs may be required to sell the home to repay the loan. In some cases, the home may not be worth enough to cover the loan balance, leaving the heirs with nothing or forcing them, in the case of a recourse loan having to pay off the remaining debt. Additionally, heirs will not inherit the property until the loan is fully satisfied.

4. Eligibility Requirements

Not everyone can qualify for a reverse mortgage. In addition to the age requirement of being 62 or older (age restrictions vary depending on the company offering the reverse mortgage), homeowners must also have significant equity in their home and be able to demonstrate the ability to cover property taxes, insurance, and maintenance costs. Also of note, reverse mortgages are only available on primary residences, so second homes or investment properties are not eligible.

5. Potential for Foreclosure

While reverse mortgages are designed to be flexible, homeowners must continue to meet certain obligations, such as paying property taxes, property insurance, and must maintain the property. If the homeowner fails to meet these obligations, the lender can initiate foreclosure procedures. This can be a concern for seniors who may not be able to manage these responsibilities, potentially jeopardizing their ability to remain in the home.

6. Complexity and Misunderstanding

Reverse mortgages can be difficult to fully understand, especially for seniors who may not be financially savvy. The terms, fees, and long-term consequences can be overwhelming, and many homeowners may not realize the full impact of the loan until later. In some cases, individuals may take out a reverse mortgage without fully understanding the costs or the effect it will have on their financial situation in the long term.

HOW ARE REVERSE MORTGAGE INTEREST RATES DETERMINED

The interest rate that is applied to a reverse mortgage varies. It depends on how the reverse mortgage is structured by the lender. Does the lender amortize the upfront costs and ongoing fees into the interest rate, or are these fees charged when the loan is set up.

The type of interest rate is also a determining factor. For example, there are fixed rate loans where the interest rate is fixed for a specific term, usually three to five years. With a fixed rate loan, the rate is fixed for the term as was shown in the previous example. Note from the table used in the example, the rate was fixed at 6.125% for five years.

Borrowers can also choose a variable rate mortgage. With a variable rate loan, the interest charged will vary over time. It can be reset monthly, semi-annually or annually, depending on how the loan is structured. The rate is usually tied to Government of Canada securities.

We don’t recommend this type of loan because changes to the interest rate can have a meaningful impact on the end balance of the mortgage. That can complicate matters in the event of a sale or when unwinding an estate.

The borrowers’ age and / or the amount of the homeowner’s equity can also impact on the rate charged by the lender. Older borrowers may be eligible for larger loan amounts, and the equity in the home can affect the terms of the loan, though it doesn’t always directly impact the interest rate itself.

The size of the reverse mortgage can also play a role in determining the interest rate. Larger loans may have different rates than smaller loans, as larger loans might pose a different level of risk to the lender. Generally, reverse mortgages with larger loan amounts may offer more favorable terms – depending on the loan to equity amount – including lower interest rates.

ALTERNATIVE SOLUTIONS

There are alternatives to the reverse mortgage. For example, the homeowner could set up a traditional mortgage and then deposit the funds into their investment account. The idea is to invest in a portfolio where the income from the investments is greater than the interest being charged on the mortgage.

It is also helpful to invest in securities that offer tax-advantaged income like using a portfolio of quality blue chip stocks that pay above-average dividends and exchange traded funds that incorporate option writing strategies. Option writing strategies typically generate dividend and capital gains income.

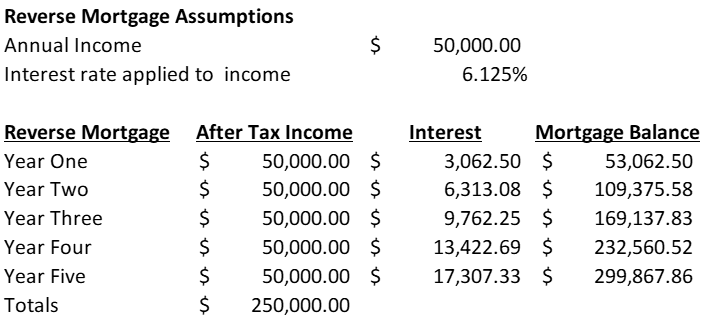

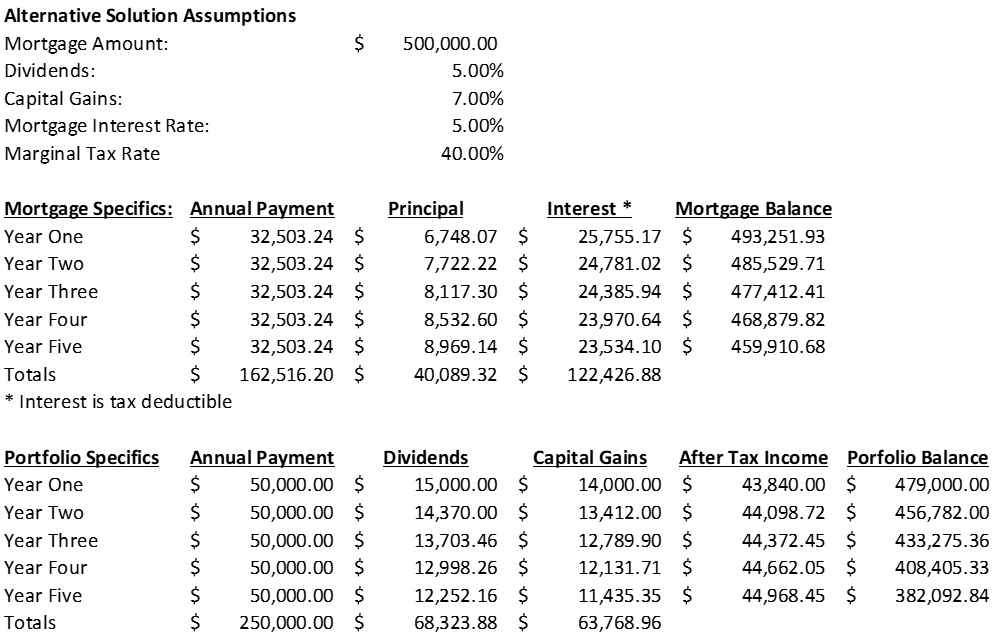

To provide an apples-to-apples comparison, we will look at a situation where the investor takes an income of $50,000 annually from the lender of the reverse mortgage. Which is to say there is no lump sum payment at the outset but rather a monthly income equal to $50,000 annually. The interest the borrower will pay is factored into the equation and the total debt payable to the lender at the end of the five-year term is then calculated. The following table examines the income oriented reverse mortgage strategy.

The alternative strategy requires the assumption of a traditional mortgage of $500,000. The investor would invest the proceeds from the mortgage in an investment portfolio that holds blue chip companies where the dividend payout is sustainable and that have a history of increasing the dividends on a regular basis. That provides an income source that offers some protection against inflation.

With a traditional mortgage, you will be required to make regular monthly payments. However, the interest associated with those installments is tax deductible assuming the capital was invested in a taxable brokerage account. How the financial markets perform will determine the amount of drawdown your portfolio will experience over the term of the mortgage.

The drawdown within the investment portfolio will be partially offset by a reduction in the outstanding mortgage balance incorporated in the monthly mortgage payments. The following table examines a situation where you receive an annual income of $50,000. We have assumed that dividends represent 60% of the income generated by the portfolio and capital gains from option writing will cover the remaining 40% of income. Any amount distributed from the dividend and capital gains component will be a return of capital.

Some additional best guesses underpin the alternative portfolio. For example, we assume a dividend yield of 5% paid on 60% of the portfolio and a 7% yield on capital gains generated by the option writing strategy which we have applied to 40% of the portfolio.

A couple of other things to think about. In the following table we assume that the value of the securities in the investment portfolio will not change over the five-year period. Nor are we accounting for any potential increase in the dividend paid by the securities within the investment portfolio. From a tax perspective, we are assuming a 40% marginal tax rate, and we have not accounted for the fact that the interest component of the mortgage can be written off over the sample period. Whereas the $50,000 income from the reverse mortgage is not taxable, the income from the alternative model is taxable, albeit at favorable rates.

There are risks of course. The equity markets may not perform as expected, which could cause the portfolio to be drawn down by an amount greater or less than expectations. One should assume that the portfolio balance associated with the alternative solution could be 20% above or below expectations during the five-year period.

SUMMARY

In our view, a reverse mortgage can be an effective tool for certain seniors looking to access the equity in their homes and supplement their retirement income. The ability to live in the home without monthly mortgage payments while gaining access to tax-free funds can provide financial relief. However, the costs, accumulating debt, potential impact on heirs, and eligibility requirements mean that a reverse mortgage is not suitable for everyone.

IS THE RUSSIAN ECONOMY COLLAPSING

Imagine a scenario where Growth Domestic Production (GDP) grew at 4%, inflation was running at 9.2% and the central bank overnight lending rate tripled (from 7% to 21%), with more hikes expected. That is the current backdrop for the Russian economy and serves as an object lesson into how economic growth and inflation interact.

One would think that above-trend growth is a good thing. Unfortunately, that’s not always the case. It depends on how the excess growth was achieved.

For example, is it the result of improved efficiencies in the private sector resulting in higher-value output? Or is it the result of excess, inefficient government spending?

Growth that is propelled by government spending rather than private sector investment usually results in above-trend inflation. And that’s the rub! The problem in Russia is that above trend growth is coming from over-the-top government spending to finance military-industrial production, in support of the ongoing war in Ukraine.

There is a popular assumption that war, or even increased military spending, will boost a nation’s economy. It is true that when a nation goes to war the surge of government investment across war-related industries can result in short-term economic gains. However, these gains affect only certain, usually isolated, industries (“conflict industry”, “war profiteers”), and it is never sufficient to offset the long-term economic cost of war.

A 2017 study done by Peace Digest, examined six major U.S. wars (World War II, the Korean War, the Vietnam War, the Cold War, and the wars in Afghanistan and Iraq) found that the costs of war negatively impacted the national economy, taxes, debt, jobs, investment, and inflation.

Key findings of the report show that in most wars public debt, inflation, and tax rates increase, consumption and investment decrease, and military spending displaces more productive government investment in high-tech industries, education, or infrastructure – all of which benefit long-term economic growth.

While military spending may offer some short-term economic benefit, after the fighting starts, and especially after it ends, the unintended consequences of military spending on the economy are severe and numerous. In short, the notion that “war is good for the economy” is a myth.

The study concluded that increased military spending had a consistently negative impact on a country’s economic growth. Even when analyzing different time periods and countries with varying GDPs, as well as when comparing military spending to other forms of government spending.

When analyzing all countries together, the findings show that over a 20-year period, a 1% increase in military spending decreases economic growth by 9%. The negative economic impact is especially apparent for most countries in the “Global North,” as seen in the authors’ observation of Organization for Economic Co-operation and Development (OECD) member states. Although there was also a negative economic impact to military spending in non-OECD countries, the negative economic impact in OECD countries was more pronounced.

We raise this issue, because the Russian economy is quickly becoming the poster child for the economic displacement resulting from outsized military spending. As the war with Ukraine morphs into a stalemate, the domestic economy in Russia is itself mutating into a military meat grinder.

President Putin’s messaging about the stability of the Russian economy has a hollow ring when citizens are pummeled by rising inflation and backbreaking interest rates. There is little doubt that the ongoing war has unavoidably damaged the economy to the point where Russia may suffer a lethal collapse.

Sanctions are also beginning to exact their pound of flesh. Initially, many analysts questioned whether sanctions were working because the economic indicators were stable. However, the long-term effect of sanctions tends to show up much later.

Secondary sanctions (US sanctions on countries that traded with Russia) weighed on other countries forcing them to limit their trade relations with Russia. Chinese banks, for example, stopped issuing US dollar letters of credit to Russians since the beginning of the war. Smaller Chinese banks stopped accepting transactions based on the Chinese Yuan with Russia.

These measures are predicated on the fear of secondary sanctions from the US. Kazakh and Uzbek companies were hit with secondary sanctions related to their dealings with Russia. Trade with Central Asia is constantly under scrutiny which means that Russia can’t use Central Asian banks for transactions. Russia’s international trade channel shrinks further as more parties collaborate with the sanctions.

Over time, Russian exports have declined forcing Putin to offer oil and natural resources to other buyers at below market prices. Meanwhile, Russia’s access to foreign currency is also restrained as sanctions were introduced, forcing the Moscow Exchange to suspend trading in Euros and US Dollars. The sanctions limited Russia’s ability to mobilize financial resources to manage a protracted war.

We know now that Russia never had the economic footing to finance a protracted war. What should have been obvious to Putin, was the risk in backstopping a war machine with an economy that relied on exports of energy and raw materials. While rising energy prices resulted in trade surpluses between 2010 and 2020, it obscured the bigger issue… that prices for energy and raw materials are inherently volatile. Without a robust manufacturing base, the Russian economy was and continues to be, saddled with an unbalanced industrial distribution.

The spilling effect of war itself has further evaporated Russia’s economic resources. These spilling effects include the lack of manpower and uncontrolled government spending which will have lingering effects long after the war ends.

Military spending has increased significantly since the war started and economists expect it to account for 40% of Russia’s expenditures in 2025. The government also provided generous subsidies to companies, from transportation to oil refineries, to sustain their economic activity. Transfer payments are also significant. The country has long-standing commitments for regions like Chechnya where transfer payments are the lifeline of regional fiscal capacity. These expenses are depleting Russia’s vital economic resources forcing Moscow to raise taxes to fund its war.

The spilling effect has also created a lack of workers in the economy. Since the beginning of the war, more than one million Russians have left the country to live abroad. These are highly educated workers with knowledge that is critical for the function of the economy. Recent reports show that 73% of Russian industry is experiencing labor shortages.

Putin wanted to create an image that Russia is still the polar bear that the world feared. However, the war in Ukraine revealed that the emperor had no clothes. Moscow’s money bag is far shallower than the world thought.

We believe in short order, the combination of sanctions, the spill effect of irresponsible government spending and manpower shortages, will lead to a Domesday scenario that annihilates the Russian economy and likely unseats Putin. If we are right, it may happen sooner than later.

At a minimum, there are ample reasons for Russia to negotiate a peace plan which would allow Ukraine to begin the difficult process of rebuilding.

Richard N Croft

Chief Investment Officer