THE FED PIVOT

Mark December 13th, 2023, on the calendar. This was the day US Federal Reserve (Fed) Chairman Jerome Powell gave the financial markets an early Christmas present… the long-awaited Fed pivot.

The impact of this subtle change in Fed policy was instantaneous. The Dow Jones Industrial Average surged like a hot air balloon on a sunny day. The Dow ended the 13th up more than 500 points with most of the momentum materializing after 2:30 pm. The Dow went on to set new all-time highs before the week ended. We expect the broader capitalization weighted S&P 500 composite index to eclipse its all-time high by year-end.

So, what changed? As you know the Fed is charged with overseeing two mandates: price stability and full employment. Given the strong US labor market, committee members were able to aggressively focus on price stability. Moreover, a tight labor market tends to precede outsized wage demands that may lead to stickier inflation.

Over the past twenty months, given that outlook, the Fed – in concert with other global central banks – raised rates at an unprecedented clip. Economists reset their forecasting inputs which yielded a near 100% probability that a major recession would occur in 2023 or early 2024.

Economists considered the Fed’s soft-landing scenario as the least likely outcome. Since a recession was already baked into the forecasts, the Fed had nothing to lose by engaging in a series of oversized rate hikes.

Economists, and we think it likely the committee members, were surprised the Goldilocks scenario unfolded. Inflation is moderating, the labor market remains strong, and barring unforeseen geopolitical events, a major recession seems unlikely.

And there lies the basis for the Fed’s change in attitude. Having escaped a recession after eighteen months of rate hikes, the Fed will now weigh both recession risk and inflation moderation, when considering future policy decisions.

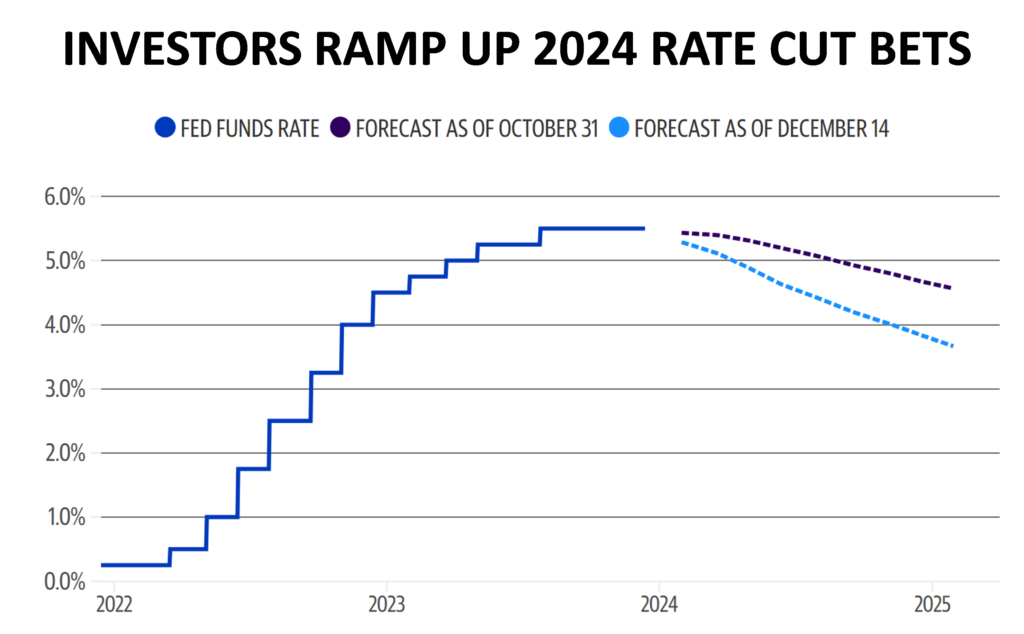

That policy shift was made clear in the Fed’s post FOMC statement that read “inflation has eased over the past year but remains elevated,” marking a change from the usual declaration that “inflation remains elevated.” The financial markets saw that change as an indication that policy decisions now favor rate cuts with economists predicting anywhere from three to seven 25 basis point cuts in 2024.

Supporting that position was the Fed’s latest Summary of Economic Projections (SEP), including the so-called “dot plot,” which maps out policymakers’ expectations about the future trajectory of interest rates. The dots show that Fed officials see 75 basis points of interest rate cuts next year, 25 more basis points of cuts than previously forecast. The Fed sees core inflation peaking at 2.4% next year — lower than September’s projection of 2.6%.

What Does the Fed Pivot Mean for Stocks in 2024?

Traders seem more optimistic than Fed messaging. In the news conference following the FOMC meeting, Chairman Powell noted that rate hikes were still on the table. But that position had no traction among market participants. On the other hand, the seven rate cuts that have been posited by some economists are equally unlikely.

We believe the last mile in the war against inflation will be significantly more difficult. Which means that rate cuts in 2024 will hinge on the degree to which the economy slows (if at all), and the impact a rate decision will have on financial markets. A rate cut would propel equity valuations prompting a wealth effect response that would likely impinge price stability. Make no mistake, these are factors that will sway any Fed decision in 2024.

On the other hand, there are unintended consequences from the record pace of rate hikes. The real estate sector comes to mind. Homeowners who currently have a low-rate mortgage must weigh the increased costs of taking on a new mortgage at a higher rate. That has had a meaningful impact on the supply of residential re-sales which is normally offset by home builders. However, higher financing costs have limited new construction which adds to the wide chasm between supply of new homes and demand from first time home buyers. The fallout is higher rental costs.

More interesting is the impact shelter costs, which include rent and mortgage payments, have on the consumer price index. As we have mentioned in previous commentary, shelter represents about 30% of headline CPI so, in a twisted way, interest rate cuts reduce inflation.

Another consideration is that 2024 is a Presidential election year in the US. We think it is highly unlikely that the Fed will make drastic moves that could be seen as influencing the election outcome.

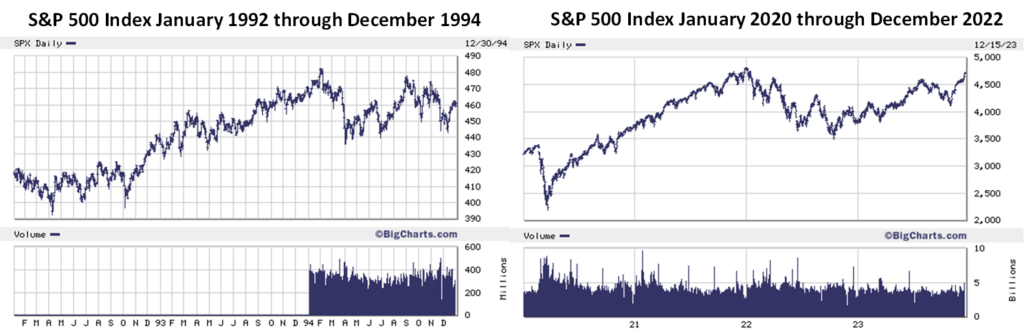

From our perspective, while any rate cuts would be a positive, we don’t need them to support a resurgence in stock prices through 2024. We think the set up into 2024 looks a lot like the set up going into 1995. Note the performance of these two datasets in the following charts.

Now consider the performance of US stocks from 1995 through to the end of 1999 as illustrated in the following chart. If we are correct about the current setup, allowing for distortions from the pandemic, one can make the case that US stocks are poised for a longer-term recovery. Which is to say, 2024 may look more like 2021, than 2022.

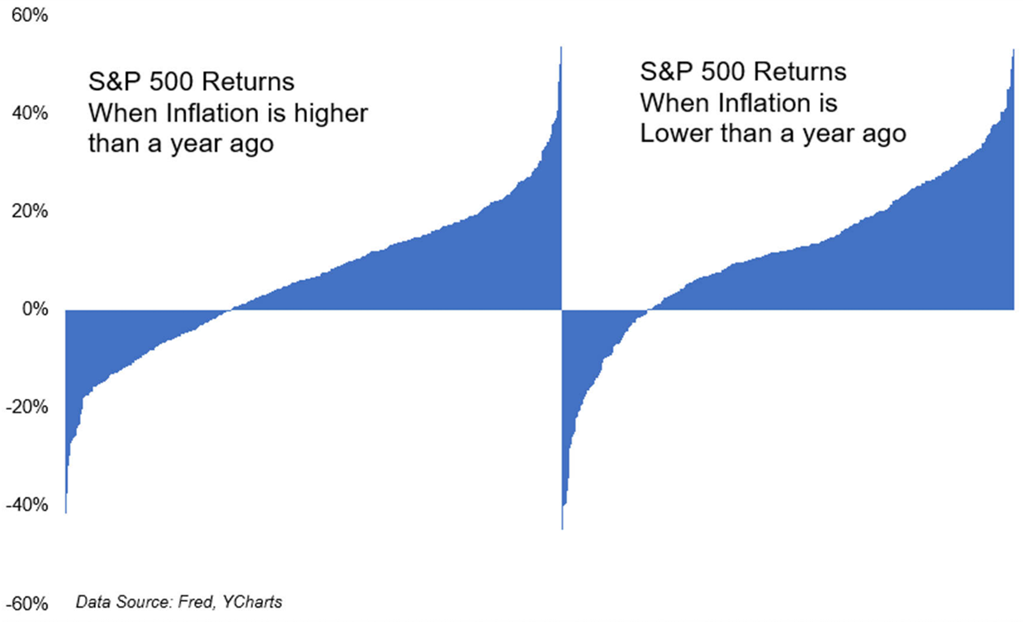

Another potential tailwind ties directly to the outlook for inflation in 2024. The following charts show the performance of the S&P 500 during years when inflation is higher or lower than the previous year. And while the charts might look identical, that has more to do with scale than reality.

The numbers tell the real story. When inflation is higher than the previous year, the S&P 500 index produced an average annual return of 6.3%. When inflation is lower than the previous year, the average return is 11.8%. This dataset suggests the odds favor a rising market in 2024 even if inflation is higher than it was in 2023.

More importantly, the only years in which the S&P 500 index declined sharply because inflation came in above the previous year occurred during periods where inflation was seriously elevated. The headline numbers and 2024 projections do not suggest any spike in prices that would fall within the elevated inflation thesis.

Sector Positioning

With the bullish case firmly in hand, we move to the sectors that we feel will outperform in 2024. We think the top sectors in 2024 will include big-cap tech, financials (i.e. banks) and small cap stocks. Two sectors at opposite ends of the style spectrum… mega-cap technology being the poster child for growth with financials representing the value names that underperformed in 2023. On the surface this may seem like a case of irreconcilable differences but think about it as a barbell approach where opposites are attracted.

If mega-cap tech outperforms in 2024, it will be the result of advances in artificial intelligence (AI). Not that 2024 will be a watershed year for AI, but rather an expansion of the learning modules that large language models use for problem solving.

The payoff will come if consumers are convinced that AI amplifies and simplifies their day-to-day tasks. Monitoring health and fitness, smart home technology, personalized entertainment are common themes.

Same with business engagement, can AI improve efficiencies, by say, writing code, producing algorithms that track sales trends, generating canned answers to common emails, logistical support for delivery services.

How consumers and businesses weigh the advantages of AI that is still in its infancy, will determine whether mega-cap tech can meet the outsized profit expectations that align with a product being promoted as transformational.

The longer-term vision is difficult to forecast, but we will be looking for clues on AI uptake by monitoring the companies that market AI solutions. Microsoft is the classic case study. If the company gets the anticipated uptake on co-pilot – the AI component that can be leased as an add on within Office 365 – it will do wonders for profitability, and on a macro level, will provide us with evidence about what value consumers place on the enhanced functionality within Microsoft’s software.

Following that train of thought, we don’t think the magnificent seven will produce the same outsized returns in 2024. Some of the seven, like Amazon, Meta and Microsoft will continue to benefit from the AI evolution. Other members of this elite group… not so much.

Netflix and Tesla are richly valued and may need some time to consolidate their 2023 gains. Alphabet has legal challenges that could hamper their upside, and Nvidia will face significant competition as end users look for ways to diversify their suppliers.

Another sector that we have been talking up is financials. The money center banks, especially the big six Canadian names, will do well in an environment with stable interest rates. The banks don’t need central banks to cut rates. What they really need is for the inverted yield curve to normalize.

Small cap stocks should also do well in 2024. Especially if central banks engage in the projected series of rate cuts. Those cuts will lift all stocks as a rising tide lifts all boats. But the biggest beneficiaries will be smaller companies that have greater leverage. As their cost of borrowing declines, that should provide some real oomph to their bottom line. Our approach is to play smaller companies using the Russell 2000 ETF[1] (symbol IWM).

PERFORMANCE DISTORTIONS

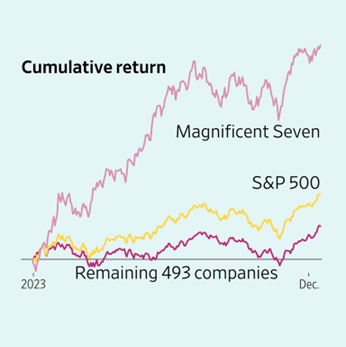

In time, we think 2023 will be remembered as the year of performance distortions. Where a double-digit gain in the S&P 500 composite index was propelled by a handful of powerful mega-cap technology stocks that emerged as the league of extraordinary tickers. Where growth stocks out-performed value stocks by the widest margin in more than fifty years as measured by the Russell 1000 value index versus the Russell 1000 Growth index.

In terms of the S&P 500 index, it all came down to the magnificent seven stocks (or eight names if you include Netflix) that generated virtually all the nearly 23.3% (as of the time of writing) year to date gains in the S&P 500 Index. Leaving in the dust a horde of value stocks with strong dividend payouts that were negatively impacted by rising interest rates and several brick-and-mortar retail businesses that were shuddered by a massive transition to online shopping.

To fully understand the impact of the magnificent seven or eight, consider the numbers. The cumulative chart illustrates the 2023 return of the seven / eight names versus the performance for the remaining 493 names in the S&P 500 index.

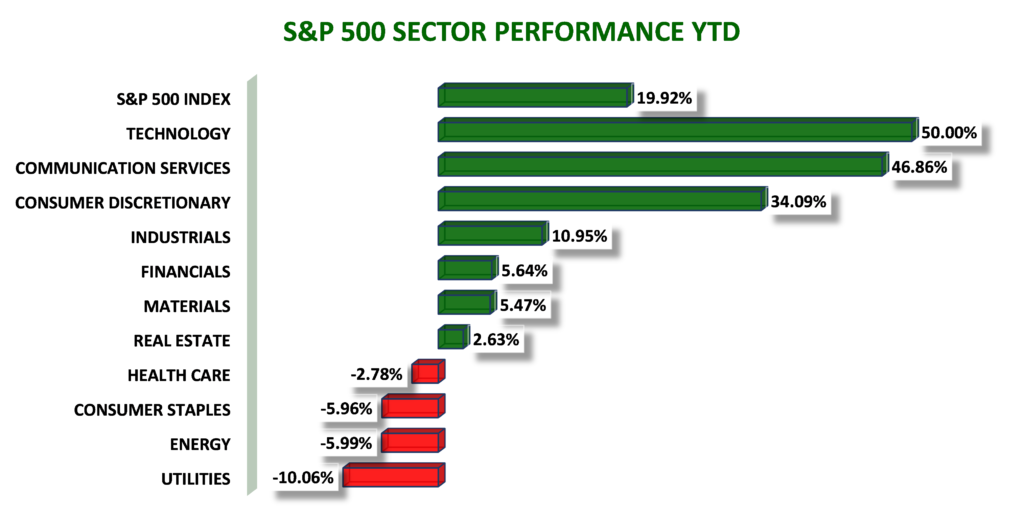

Further evidence can be found in the S&P 500 sectors, where the 2023 upside momentum in the broad index came down to three sectors: Technology, Consumer Discretionary and Communication Services. In fact, the remaining eight sectors that make up the S&P 500 index had no impact on overall performance.

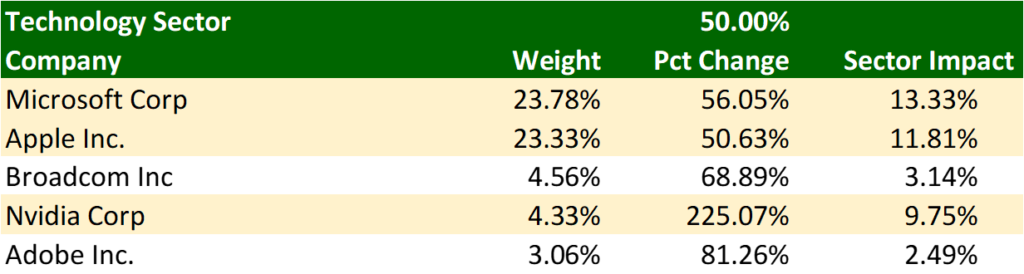

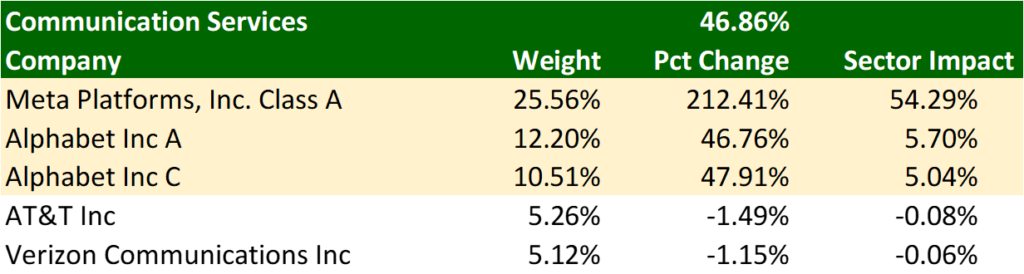

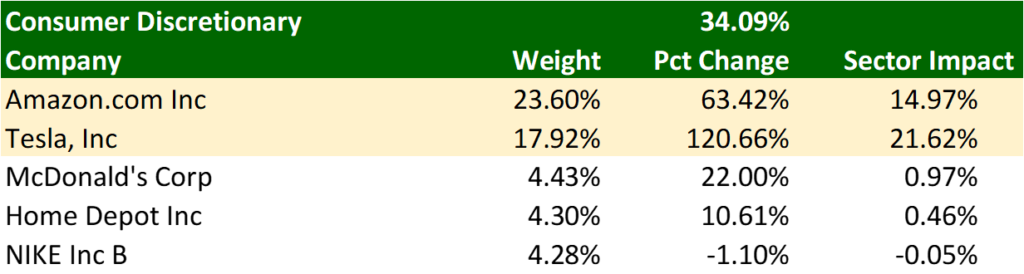

Digging a little deeper, we breakout the most overweighted companies within those three out-performing sectors as set out in the following tables (we have highlighted the magnificent seven):

The performance distortion is palpable and underpins the disconnect that has swayed investor sentiment. The feel-good story that should have permeated 2023, is skewed by the fact that a small number of stocks generated such outsized returns.

As we enter 2024, it begs the question… where do we go from here? Do the remaining 490+ stocks that comprise the S&P 500 index play catch up to the magnificent seven or do the mega-cap tech names succumb to the pressure of mean-reversion.

The on-again-off-again recession debate comes down to the higher rates for longer thesis. If central banks maintain their hawkish stance for too long, or worse, raise rates further, there is a risk that it will slow economic activity to the point that consumers tighten their belt. That will have a negative impact on all sectors, leaving no place to hide. But that scenario is not likely given the previously discussed commentary from the Fed.

Additionally, we believe global economies have been feeling the pinch of a rolling recession for the past eighteen months. It is like a game of high-stakes musical chairs where one sector turns down while another recovers. That push and pull effect tends to soften the fallout to the overall economy in much the same way as diversification reduces portfolio variability.

The implication of the rolling recession thesis is that a major recession in 2024 is highly unlikely. More importantly, in terms of investor sentiment, it is becoming the mainstream view among economists. While that doesn’t make it so, it is nice to see that market participants are shifting towards our way of thinking.

The risk to the no-recession thesis rests on a couple of factors; 1) the global economy is not subjected to a geopolitical shock and 2) that the rest of the world plays catch up to the outsized performance of the US economy.

We can do nothing about geopolitical tensions because they are unpredictable. However, the catch-up position is something we can look at and try to make an educated guess as to the outcome.

The US economy is an outlier on the world stage. Where most of the G-8 economies are feeling the pinch of higher rates, the US economy was insulated somewhat by the US $2 trillion in stimulus provided by the Biden Administration’s “Inflation Reduction Act.” Nothing on that scale occurred in the other industrialized economies.

Canada is a case in point. It has not experienced a US style rebound because efforts to stimulate our economy have been offset by weak productivity and capacity utilization.

The Liberal government has expanded certain programs (i.e. universal dental care), as part of their “supply and confidence” agreement with the New Democratic Party. These may be excellent social programs, but they do not have the same impact on growth as say, new investments in manufacturing.

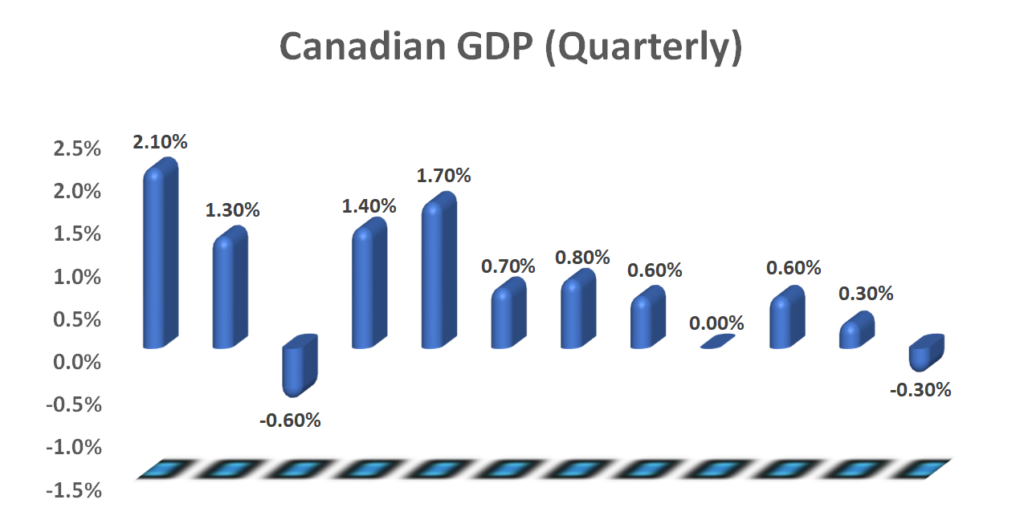

Canadian GDP contracted by 0.3% in the third quarter of 2023 evidence that aggressive rate hikes were influencing consumer behavior. Household consumption, which represents about 70% of GDP, was basically flat in the third quarter. A slowdown in exports and tighter inventory control amplified the downside momentum.

On an annualized basis, Canadian GDP contracted by 1.1% in the third quarter which was well below market expectations of 0.2% expansion. The other G-7 members are dealing with similar problems illustrating that aggressive central bank policy without excess stimulus, has a more pronounced impact on GDP growth.

The question is whether G-7 consumption will be sufficient to spur forward momentum or, at a minimum, not detract from the growth provided by US leadership. In that scenario G-7 members, notably among them Canada, will likely engage in rate cuts before the US.

There are a couple of other themes where a mean reversion should allow a reset in 2024. The first is the massive divergence between value and growth in 2023. The other is the roller coaster ride experienced by the energy sector.

The chart to the right compares the 2023 returns for the Russell 1000 Value Index to the Russell 1000 Growth Index. The relative outperformance of growth versus value was more pronounced than anything we have seen in the last 50 years. The rapid upward trajectory of short-term interest rates brought bonds into the spotlight as a competitive asset class to value stocks that typically pay above average dividends. If we see rate cuts in 2024, that will impact the competitive advantage that corporate bonds currently enjoy. That would provide fertile ground for the value stocks to play catch up.

Chief Investment Officer

[1] The Russell 2000 Index is a stock market index that measures the performance of approximately 2,000 small-cap stocks in the United States.