COVERED CALLS: A CLOSER LOOK AT THE STRATEGY’S HIDDEN COMPLEXITIES

Picture this, while sitting in your kitchen contemplating the meaning of life or at least, the performance of your portfolio, you read an article questioning the value of writing covered calls. Suddenly the heartache of lost opportunity washes over you because covered call strategies are part of your portfolio that supposedly generates tax-advantaged income.

As a firm, we have long used covered calls as a tax-efficient strategy in many of our portfolio mandates for investors seeking income. It’s not the only strategy in our income mandates, but it is one that we pride ourselves on being able to manage successfully.

To that point, we believe it is important to dispel some of the concerns raised about the downside risks associated with the strategy to wit… lost opportunity cost.

Opportunity cost is that sly personality glitch better known as greed. It’s the devil on your shoulder asking the question: what if the stock price skyrockets above the call options’ strike price? You might end up feeling like the kid who pinned a Mickey Mantle rookie card to the spokes of a bicycle to mimic the sound of a motorcycle. Ouch!

The covered call detractors argue that the strategy caps the upside and does nothing to hedge against downside risk. That position is partially true although the premium received from the sale of the covered call does provide some downside buffer. The point is a declining stock will create a greater loss for the unhedged stockholder than it will for the investor who sold covered calls. Moreover, the price decline is related to the underlying stock, not the option strategy.

Taking that argument a step further, the detractors argue that opportunity cost is greater in a volatile market environment. Again, that is only true if the option market has understated future volatility. Something that we acknowledge happens often.

Still, the premium received from the sale of a covered call accounts for volatility as that is a key input in the calculation of the option’s price. The more volatile the underlying security, the higher the option premium, and thus, the greater the amount of money you will receive from the sale of the covered call.

Psychologically, as Sigmund Freud might argue, the allure of covered calls is rooted in a desire for security and immediate gratification. In this case, the premium received. However, those who shun covered calls argue that the premium received overlooks the unconscious acceptance of the risk of losing the stock’s potential growth, a trade-off that may not be in the investor’s best interest.

That point is well taken. Although it assumes that investors who engage in the strategy are looking for growth. In many cases, they are seeking above average tax-advantaged income with a measure of stability. And there, covered call writing is particularly attractive as the option premium is taxed as a capital gain. Which is to say, you only pay tax on half the income received.

The other factor that is lost in the debate is the assumption that a covered call position is held to maturity. It ignores any follow up trades, where one might cut losses by rolling down the initial short call, or simply unwinding the position at a loss. In that latter scenario, isn’t that the same problem faced by the individual who owns the stock without the sale of any call option.

Follow-up strategies are also employed in a rising market. The initial short call could be re-purchased, and another call could be sold with a higher strike price and perhaps a longer expiration date.

We agree that the strategy’s effectiveness is contingent on market conditions. In a bull market, the call seller misses out on substantial gains, a point that would concern investors in the accumulation stage of their life cycle.

However, if you are building a diversified portfolio risk management and tax-efficiency are critical. In terms of risk management, growth and balanced investors would presumably hold assets such as bonds and cash that generate income and hedge against downside risk. We think covered calls within those mandates provide another tool that enhances fixed income exposure. We believe employing a smaller weight to the covered call strategy allows us to up the exposure to cash, providing similar – if not exact – diversification with superior outcomes.

The conclusion is that covered calls can be helpful in certain situations if your manager is schooled in the strategy’s limitations and risks. It is not a panacea for market volatility or a substitute for thorough analysis and risk management. As with any investment strategy, diligence and a balanced perspective are crucial for success.

Portfolio management is a long journey paved with informed choices, buffered with a clear understanding of the investor’s objectives, time horizon and risk profile working with an Advisor that can navigate the market’s vagaries with a level head and a well-researched plan.

TRADING BITCOIN WITH AN OPTION OVERLAY

Investors have become smarter in much the same way as parents do when their children age. It’s not that parental pronouncements or investor decisions are sharper, but the environment in which they are made makes them appear more intelligent.

I raise this because Bitcoin investors have enjoyed a raging bull market that seems to defy gravity. Buying crypto, the classic risk-on trade, has been rewarded by the age-old axiom that a raging bull market lifts all asset classes. The trick is to know when a rally that turns on fantasy becomes a bubble burst by reality.

That said, we cannot ignore the exposure – or notoriety – underpinning the crypto industry. Bitcoin and Ethereum have become representative indexes, and investors are constantly bombarded with the notion that crypto is a viable asset class. Whether it provides the diversification one might get from say, gold, is questionable. But like it or not, we cannot ignore the veracity of the crypto market. The trick is to embrace the potential while managing the risk. And there lies the rub!

Crypto trades in an ecosystem where fundamentals do not apply… at least not yet! Crypto is a classic risk-on trade motivated by FOMO (the “Fear of Missing Out”) and supported by “herd instinct” where investors blindly follow the crowd instead of their own analysis. It reminds me of the quote attributed to General George Patton: “If everybody is thinking alike, then somebody isn’t thinking.”

Momentum propelled by emotions is not a backdrop where one can apply rational thinking. To counter that, we have taken a small bitcoin position in the Conviction Equity Pool employing an option strategy that capitalizes on the inherent volatility of the underlying asset and takes advantage of mathematical certainties underpinning time value decay.

By utilizing mathematical certainties, we take unbridled optimism out of the equation. That makes it easier to manage market skews which is critical in a world where algorithmic strategies and day-trading phenomena create seismic shifts that are unpredictable.

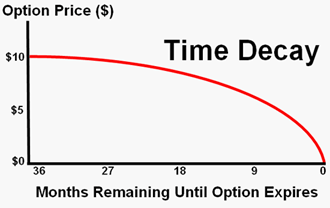

The mathematical certainty is the time value decay in an option’s price. An option’s price is calculated using six inputs: the current price of the underlying security, the strike price of the option, the risk-free rate of interest, dividends if any paid by the underlying security, time to expiration and an estimate of volatility.

Mathematically, time decays exponentially. Which is to say, a nine-month option has about twice the time value of a three-month option (3 being the square root of 9).

Similarly, a four-month option has about twice the time value of a two-month option (2 being the square root of 4). The accompanying chart tracks normal equity and index time decay.

The other factor that is relevant in this exercise is the volatility within the crypto market. Bitcoin, for example, is about three times more volatile than the average equity, which means that crypto options are about three times more expensive than the average equity option. Taking these factors into account, we have developed a crypto model where we hold a security that provides crypto exposure and against the position sell short-term options to take advantage of the time skew and the underlying volatility.

BACKGROUND

Return with me to April 1999 when we were nearing the end of the internet bubble. At the time I invested in two high flying internet stocks – AOL Inc. and Yahoo – that were poised to become long-term success stories. With 20-20 hindsight we all know how that story ended.

Still, my aptly named “double-up, double-down” strategy generated sufficient medium-term profits to fund the secondary education of my three children. To be fair, it was helped by the bullish tenor of the market, but the strategy did not require the underlying stocks to rise for my account to earn the maximum return on the trade. I see similar metrics in the crypto market.

In April 1999, I penned a column in the Globe and Mail that explained the strategy using Yahoo! Inc. I was faced with the portfolio manager’s dilemma of managing expectations within the context of FOMO. In the current environment, one cannot deny the momentum that has washed over the crypto space, but from a risk management perspective, a portfolio manager must be cognizant of the fallout from being wrong.

The objective of the “double-up, double-down “strategy is to utilize a volatile stock to generate significant upside with an exit point at or below the current market price. I also want to manage risk by limiting the overall exposure within the Conviction Pool by establishing a reasonable average price point should crypto yield to the laws of mean reversion.

In April 1999, Yahoo! Inc. was trading at $187 per share (all prices in US dollars). In the previous year, the stock had traded as high as $222 and got as low as $126. My logic for selecting Yahoo! Inc. was based on the following commentary penned in the April 1999 column:

Yahoo! Inc.’s effort to expand content was the driving force behind their recent merger with Broadcast.Com. The objective of providing surfers with streaming video is seen as the next major evolution on the internet. How soon we watch content on the internet as we now watch television will depend on how fast broadband becomes a cost-effective alternative to traditional 33.3 dial up access.

In that regard, a study by Computer Economics showed that the total number of digital subscriber lines (DSL) installed in the US will grow dramatically in the next five years. Eventually exceeding 10 million lines, with the greatest growth occurring between 2002 to 2003.

Another study from The Strategis Group suggested that the cable modem market share – the current choice among residential households for high-speed internet access – will fall to 68 percent of the residential market by 2003. Competition inevitably lowers prices, ultimately increasing demand for high-speed access and the need for evolutions in streaming video. Perhaps not tomorrow or next year, but certainly within the next five years.

Cheaper access and the exponential growth of consumers logging on is the model that will drive future profits for the best internet companies. The basic business model for Yahoo! Inc is a classic case study as to how a company exploits those demographics. Each step in Yahoo! Inc’s evolution requires the company to provide more services to consumers, which increases the amount of time consumers spend with these companies which, in turn, increases their attractiveness to advertisers.

How times have changed! In the fullness of time, Google became the internet’s preeminent search engine and Meta exploited social media that destroyed Yahoo! Inc.’s content initiative. Despite the unknowns that were unpredictable, I was able to generate double digit returns before the turn of the century.

THE STRATEGY

In 1999, I looked at a strategy where my return was not based on Yahoo! Inc being able to fulfill its aggressive potential. The thesis of the 1999 article was that investors who felt comfortable owning 200 shares of the stock consider buying 100 shares of Yahoo! Inc. and against that position sell one long-term call and one long-term put option. The explanation went as follows:

The approach I favor is one that sells expensive options. As a point of reference, consider that the average implied volatility for an equity option (April 1999) is 35%. Compare that to the Internet highfliers. Options on Yahoo! Inc., for example, have an implied volatility of 80%.

There are a couple of reasons for this type of strategy; 1) the strategy allows you to enter the internet game one step at a time with an acceptable price target given a worst-case scenario, and 2) should the stock remain where it is or rise, you can in some cases, more than triple your initial investment over the next 21 months. For the record, the double up double down strategy is really a covered combination.

The idea is to buy 100 shares of Yahoo! Inc. at $187 (price at the time of writing), and immediately sell one Yahoo! Inc. January (2001) 150 call at $93 ½ and one Yahoo! Inc. January (2001) 150 put at US $46 ½.

Here’s what the strategy entails. The out-of-pocket cost for the initial 100 shares of Yahoo! Inc. is $47 per share. That’s $187 for the stock less $140 per share received from the sale of the two options ($93 ½ for the call, $46 ½ for the put). The call and the put expire in January 2001 (remember I was writing this in April 1999), twenty-one months from the date the position was established.

The Yahoo! Inc. January 150 call obligates you to sell your 100 initial shares of Yahoo! Inc. at $150 per share anytime between now and the third Friday in January 2001. If the stock is above $150 per share in January 2001, the call will be exercised. At which point you simply deliver the shares to the call buyer and in the process, receive $150 per share for your shares.

Under this scenario the January 150 put will expire worthless. Since the out-of-pocket cost on the original 100 shares was $47, and since you receive US $150 per share 21 months from now, that’s more than three times your original investment, or more precisely, 197% return on your initial investment. That’s the best-case scenario.

The January (2001) 150 put obligates you to buy an additional 100 shares of Yahoo! Inc. at $150 per share until the January 2001 expiry. If the stock is below $150 per share in January 2001, you will be forced to buy another 100 shares at the $150 per share strike price of the put.

Under this scenario, the calls will expire worthless. The initial 100 shares of Yahoo! Inc. cost $47 per share (out-of-pocket cost) and the second 100 shares – assuming you are forced to buy them – will cost $150 per share. The average cost of the 200 shares in January 2001 would be $98 ½ ($47 + $150 = $197 divided by 2 = $98.50).

Under the worst-case scenario, you end up with 200 shares of Yahoo! Inc. at an average cost of $98 ½ per share which is just a little over half the current price of the stock and represents the double down element of the strategy.

BACK TO THE PRESENT

Returning to the present day and substituting the internet craze for the crypto euphoria, here is how we are playing Bitcoin in our Conviction Pool. Rather than buying Bitcoin ETFs which have been available in Canada for some time, but just recently received SEC approval in the US, I chose to trade Micro Strategy Inc. (MSTR, Nasdaq) as a leveraged Bitcoin play.

MSTR provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. At the time of writing MSTR was trading at $1,525 per share but it typically moves more than $100 per day up or down on any given day.

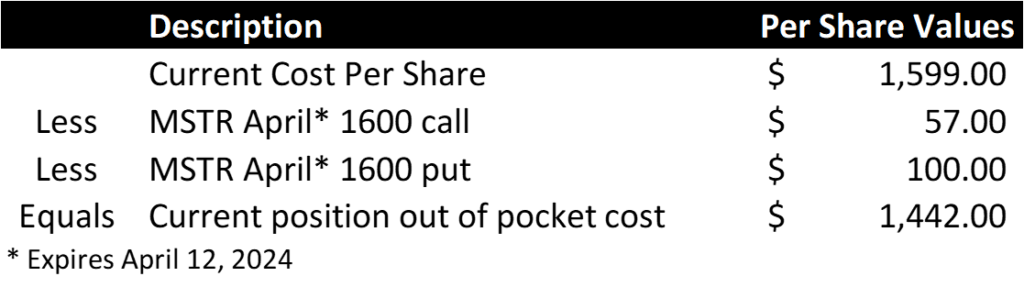

The over-the-top volatility of MSTR presents an interesting option play where we could start with an initial position of 300 shares and against that position sell one-week calls and puts. Specifically, we purchased 300 shares of MSTR against which we sold three one-week call options with a strike price of $1,600 and collected $57. We then sold three one-week put options with a strike price of $1,600 and collected $100.

I used short-term options because they were trading with an implied volatility of 160% which is two times the implied volatility that was associated with the Yahoo! Inc. trade. Which is to say, the MSTR options are more than two times more expensive than the aforementioned Yahoo! Inc. options.

With MSTR, we are taking advantage of the extreme volatility associated with Bitcoin and the excess volatility of the underlying stock. The Bitcoin connection reflects the MSTR balance sheet which is almost entirely invested in Bitcoin. Historically, MSTR has been about three times as volatile as Bitcoin. With that in mind, the following table is an example of the most recent trade where we sold options on April 5th, 2024.

I should point out that the current cost per share reflects the cost of the MSTR shares since the strategy’s March 11th, 2024, inception date plus any subsequent buys and sells of the stock between March 11th, and April 12th.

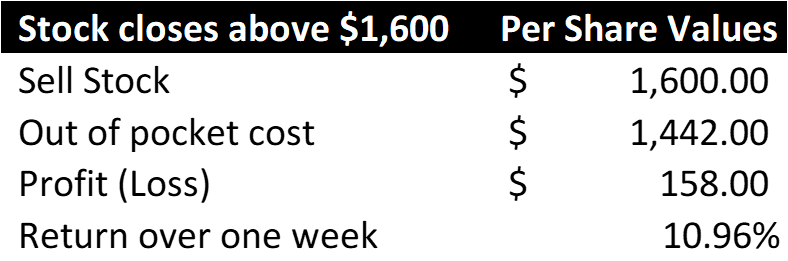

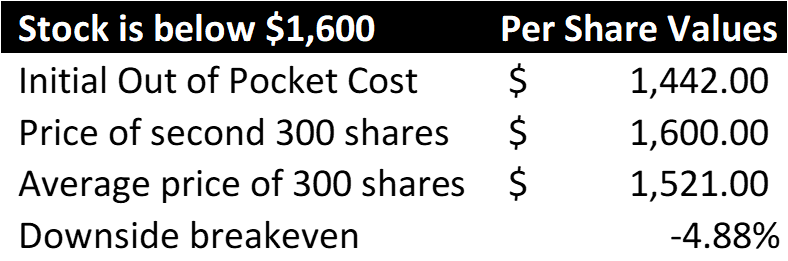

Using those criteria, the following table examines the possible outcomes that will occur on the April 12th expiration date. The table does not include any subsequent trades that might occur on or before April 12th. It simply serves as an illustration of the strategy and the possible outcomes.

As mentioned, we began the strategy on March 11th, 2024, and have sold weekly options against the shares on a regular basis. Since March 11th, 2024, the strategy has generated $314,880 in profits from the sale of the options and has lost $12,500 on the stock position. The net gain since March 11th, 2024, is $302,380 for a one month return of 58.58%. Since the strategy represents about 10% of the value of the Conviction Pool, it attributed 5.86% to the one month return on the overall portfolio.

For comparison purposes, Bitcoin closed at $72,292 on March 11th and at the time of writing (April 11th) it was trading at $70,040 reflecting a one month decline of 3.12%. The difference in returns (+58.58% versus -3.12%) reflects the value of utilizing mathematical certainties to manage irrational enthusiasm.

Richard N Croft

Chief Investment Officer