ANIMAL SPIRITS

Since the landslide victory of Donald J Trump, the stock market has surged to record highs propelled by animal spirits. To understand animal spirits, imagine the stock market as a jungle, and investors as a pack of excitable monkeys. Picture them frolicking among the trees, with talk of “nineteen to the dozen” as the old saying goes, when the market rallies and shrieking in panic when it declines.

Animal spirits was a term coined by the famous economist John Maynard Keynes. It represents the psychological and emotional factors that influence investor behavior. When confidence is high, our monkey friends are fearless, taking big leaps and making bold investments. They cheer and throw bananas when stocks rise, driving the market to new heights.

But when fear sets in, it’s a different story. The monkeys start hoarding their bananas, refusing to take risks. They huddle together, eyes wide with worry, and the market takes a nosedive. This rollercoaster of emotions—confidence, fear, greed, and panic—creates the rise and fall of the stock market.

When the stock market is in rally mode, animal spirits play a significant role by driving investor optimism and confidence. When economists talk about green shoots, investors feel hopeful about the future. Believing that the trend is your friend, investors jump into the market buying stocks, even if current economic indicators don’t fully justify their optimism. This surge in buying activity pushes stock prices higher, creating a self-reinforcing cycle of rising prices and increasing confidence.

Irrational exuberance drives herd behavior as retail investors jump into the game driven by the fear of missing out (FOMO). Herd mentality amplifies market movements eventually leading to speculative bubbles. The point at which stock prices rise far beyond their intrinsic value due to excessive optimism and speculation.

The green shoots narrative about the economy or specific sectors can fuel investor enthusiasm, further driving up stock prices. In the end, animal spirits drive markets to new heights that eventually leads to excess volatility and potential market corrections. Understanding these psychological factors is crucial for navigating the complexities of the stock market.

When investors lose confidence in the economic fundamentals, they become frozen, fear takes hold making it difficult to make tough decisions. Much like the monkey’s hording their bananas, investors get caught in a negative feedback loop as the greed quotient that led to higher prices gives way to fear and panic. The problem is that markets fall much faster than they rise.

There is a marked shift in herd behavior that causes panic selling as smaller investors try to avoid a downward spiral. Green shoots become red warning signs as the narrative changes from positive to negative. Volatility exaggerates the move to the downside. The key for money managers is to recognize the warning signs before it is too late.

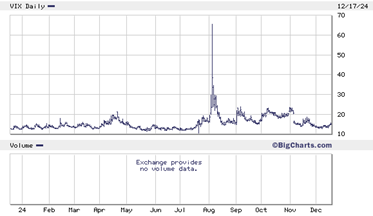

So far, we remain in an upward sloping trajectory. Volatility (see chart below), based on the CBOE volatility index (VIX) remains muted which suggests that we have not reached a speculative bubble. The narrative remains positive as economists talk about the potential benefits of corporate and personal tax cuts, which is good for corporate after-tax profits and consumer sentiment.

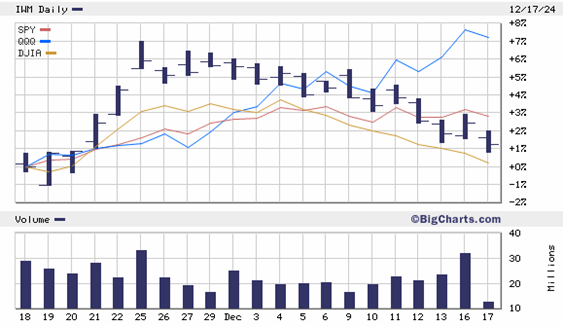

The main beneficiaries of this outlook will be small cap companies within the Russell 2000 index (see the Russell 2000 ETF symbol IWM) that have a made in America strategy. Such companies will gain the most from continued tax cuts and ideally, lower interest rates. They will also be immune to tariff threats since they manufacture products domestically.

So far, the results have been mixed. seeing this play out. Since Trump’s landslide victory, IWM has outperformed the Dow Jones Industrial Average but has underperformed the Nasdaq 100 Index. It has performed in line with the S&P 500 index that has been boosted by its exposure to mega-cap tech (see chart below).

We suspect this trend will continue into the new year. But once Trump is inaugurated and begins signing his threatened executive orders around tax cuts and tariffs, which now are viewed as a wash, investor psychology could change.

Economists will weigh the unintended consequences which could alter the narrative. That could shift sentiment if tariffs become a reality rather than a negotiating ploy. Companies with global exposure (Apple, Tesla, Meta, Google, J P Morgan, Goldman Sachs) will be impacted by a hard-line strategy that could lead to a tit for tat response from trading partners.

The first shoe to drop in this high stake’s poker game will be the currency markets which will become more volatile as foreign currencies weaken against the US dollar. As the US dollar rises, it will hinder the ability of exporters to compete with lower cost alternatives.

Across the US economy, prices will rise as tariffs work their way through the system. The bump in prices will be short-lived as tariffs create short-term aberrations with less intrusive long-term consequences.

Still, that could short-circuit the US Federal Reserve’s ability to continue cutting interest rates. We suspect that Trump will institute a series of carve outs to dampen the short-term inflationary impact of across-the-board tariffs. Top of the list would be oil and gas from Canada. Nothing will infuriate his base more than higher prices at the gas pump.

We are not saying with certainty that it will play out this way. No one really knows! However, if we look at history as a signpost, there is a distinct possibility that the past is a prelude to the future.

The objective is to watch for the early warning signs – increased volatility in the currency markets, subtle changes in the narrative – and to act before there is a marked shift in animal spirits. You will have some time because shifts in sentiment do not happen overnight. But when sentiment does shift, the fear that will accompany a downward spiral is palpable.

Subtle shifts in the narrative are just that… subtle. The trick is to read between the lines. For example, on December 11th, the US Bureau of Labor Statistics released the latest inflation data. The consumer price index rose 2.7% in November slightly higher than the 2.6% reading in October.

The focus has been on the direction of inflation and the impact that will have on how many rate cuts the market can expect from the US Federal Reserve (Fed). Lower rates are good for stocks and the notion that investors are being backstopped by a more dovish Fed has been one of the factors driving equity markets higher.

The November inflation data while not significant, did mark a change in trend. Assuming inflation and the impact that could have on Fed policy has been one of the main drivers of rising equity prices, one would assume that the CPI data would be seen as a negative by market participants.

But when the US markets closed at the end of December 11th, the Dow Jones Industrial Average as expected, declined by 0.22% (-99.27 points). However, the S&P 500 index moved up by 0.82% (+49.28 points) and the Nasdaq 100 surged 1.77% to close at an all-time high above 20,000 (20,034 to be exact). So… what happened?

Obviously, daily repositioning is not a trend. But beneath the surface there appears to be a subtle shift in sentiment that may re-focus the narrative. Traders are becoming more focused on the growth story and less concerned about how the Fed is likely to react to less than favourable inflation data. Which is to say, traders are not relying on rate cuts to spur further upside.

The outperformance of the mag-seven stocks which drove the Nasdaq 100 to record highs is the tell. Broadcom surged 6.63%, Tesla was up 5.93%, Alphabet, Meta, Amazon and Netflix all sitting at 52-week highs.

We are not suggesting a wholesale change in one’s investing strategy. Trying to time the market is not a particularly useful strategy. We believe it is better to engage in a risk-off trade as early warning signs become more prevalent. For example, reducing exposure to equities by transitioning some of our portfolios into short term cash equivalents (i.e. Treasury bills, or high interest saving accounts like Purpose High Interest Savings ETF, symbol PSA).

Other strategies would include reducing exposure to passive index-based ETFs to more actively managed products. For example, reducing exposure to say the SPDRs Index ETF (symbol SPY) into lower risk alternatives such as Berkshire Hathaway (symbol BRK.B).

Berkshire Hathaway is already holding historically high cash levels. That’s a concern, but by Buffett’s own admission, he is usually early when making strategic changes in his portfolio. Bearing in mind that his better early than late strategy reflects the liquidity constraints of such a large portfolio.

Because our clients have no such constraints, we can be more light-footed. We can engage with our animal spirits, enjoy the bullish ride while being prepared with risk management strategies before we see a major shift in sentiment.

After all, in the world of animal spirits, it’s a jungle out there.

BEST OF TIMES OR WORST OF TIMES

The current state of the economies of the USA and Canada can indeed be described using Charles Dickens’ famous line, “It was the best of times, it was the worst of times.”

The Canadian economy often feels like riding a snowmobile piloted by a moose. On the one hand, the Organization of Cooperation and Development (OECD) predicts that Canada will grow its’ GDP at a faster rate than all G-7 nations in 2025. On the other, we have tariff threats that could scuttle any benefits of the aggressive rate cuts by the Bank of Canada.

To this point, Canada has avoided the recession that most economists had predicted. Inflation has been tamed falling from its June 2022 peak of 8.1% to 2.0% based on the most recent data from Statistics Canada. That’s good but like the data from the US, Canadian inflation is well above the 1.6% rate at the end of September 2024.

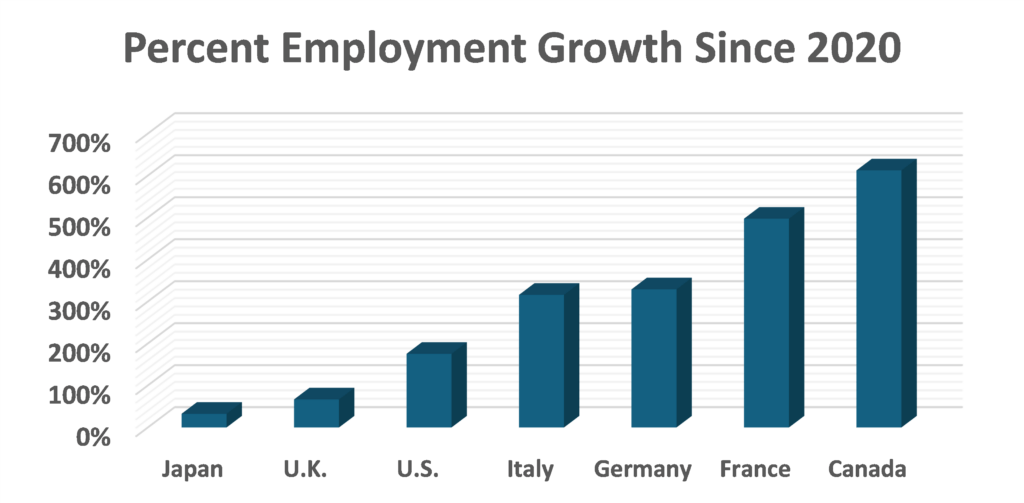

Canadian employment numbers have been stronger than any of the G-7 members since 2020. But that is likely the result of our generous immigration policies. That will change in early 2025. So far, the labour market appears solid with 50,500 new jobs created in November 2024. But, when you look under the hood, we note that 87% of those new jobs came from the public sector and the unemployment rate increased to 6.1%.

Stephen Poloz, former Chair of the Bank of Canada, weighed in with some chilling comments. He believes the November employment numbers suggest that Canada may already be in a recession pointing to Canada’s immigration policy.

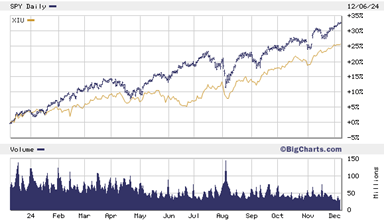

Immigrants create new jobs and spending to buy necessities. As the Liberal government tightens immigration rules that tailwind will be less impactful. Which is to say, the numbers may be masking a more serious problem. It may also explain Canada’s lacklustre performance of our stock market relative to the US.

Returning to our snowmobile analogy, Canadians are passengers on an unpredictable ride trying to dodge threats from our neighbour to the south. No easy task regardless of who ends up leading the country after the next election.

Tailwinds such as tariff threats are only the tip of the iceberg. Trumps tax reduction strategies will force Canada to follow suit or face a brain drain to the US.

Specifically, the recent hike in the capital gains inclusion rate will have serious repercussions considering the proposed capital gain reductions in the US. As an aside, it is important to understand that the increase in the Canadian capital gains inclusion rate has not been set into law. If the government falls in a non-confidence vote, the capital gains inclusion rate dies on the table.

We will also need to reduce our personal and corporate tax rates if we are to have any chance of being competitive. The digital services tax is also on the table as we prepare to negotiate a revised USMCA. Something that Trump will want to discuss early in his tenure.

The bloated Canadian government will have to shrink to match the streamlining proposed by the US Department of Government Efficiency (DOGE). Hopefully some of the jobs will end up in the private sector. But if Canadian companies cannot address the country’s abysmal productivity record, any new private sector jobs won’t produce anywhere near the growth rate necessary to fall in line with the OECD’s 2025 outlook.

Despite the fact these policies are being thrust upon us by external elements, these are positive changes that are long overdue. But they will have to be considered within the context of increased spending driven by those external factors.

At the top of that list, Canada will be forced to meet NATO’s 2% GDP target for defence spending. Trump will make that a priority whether we like it or not.

These necessary changes are unlikely to be set into law under a Liberal regime. Especially with the Liberal’s politically driven GST holiday and the potential $250 contribution payable to Canadians who earned less than $150,000 in 2024. If nothing else, these “political gimmicks” will eliminate any possibility that the government will meet their deficit target. Which is to say, the tax and spend strategy will likely remain in place at exactly the wrong time.

Despite the potential headwinds, private sector forecasters expect 2025 to bring further progress. Hopefully, those rosy forecasts are based on more than a glass half-full point of view. In support of these prognostications, Canadian interest rates will be lower in 2025 as inflation remains within BOC’s 2% target. We do not expect additional jumbo rate cuts as we saw in mid-December. The BOC has made it clear in their December commentary that rate reductions will slow in 2025.

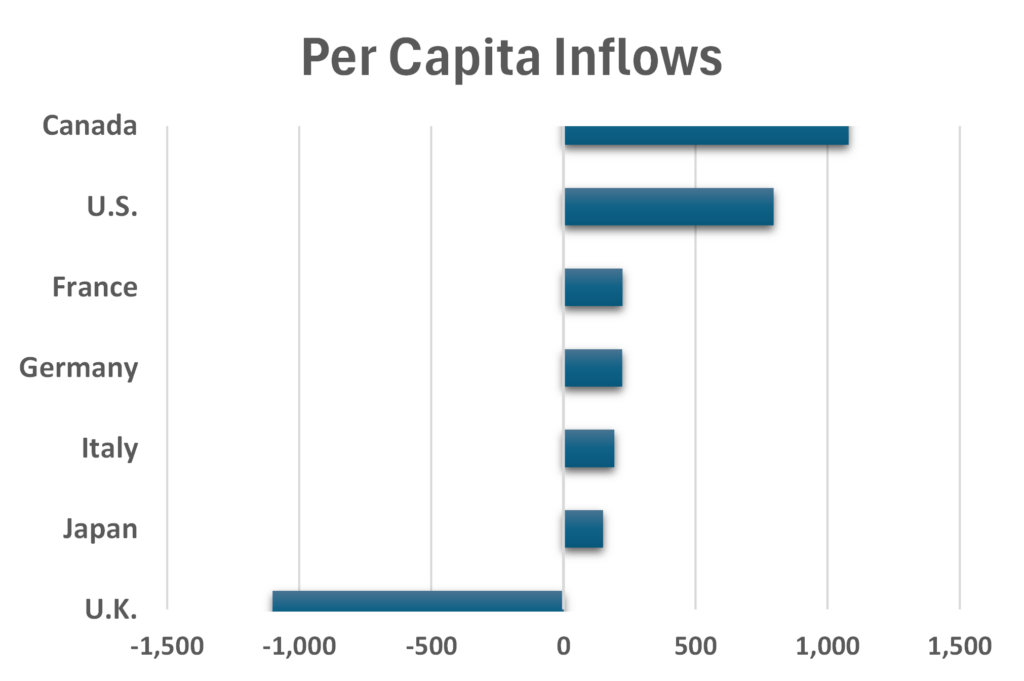

Canada is also benefitting by a positive flow of funds. Canada received the highest per capita foreign direct investment in the G7 through the first three quarters of 2023. Whether that continues will rest in our tax and spend policies. The results after the next election will provide some clarity on whether capital will continue to flow into the country.

At the same time, Canadians are facing challenges as some of the biggest factors in the cost of living, such as groceries and housing, remain elevated. For too many Canadians, hard work isn’t paying off.

The government must take steps to ensure that younger Canadians don’t get left behind. Millennials are now the largest Canadian generation, having surpassed baby boomers in July 2023.

Millennials’ success in the workforce is Canada’s success. But their success depends on how we embrace innovation and increase productivity. That will result in higher real wages but creating more high-quality jobs that allow Canada’s economy to reach its full potential.

There are some positive policies that address these issues. For example, enhanced Child Benefits, Canada-wide affordable child-care, housing construction, enhanced benefits and pensions for seniors. These policies have made life more affordable for Canadians and have improved access to housing which have already enhanced economic growth and competitiveness.

Those are fair points but will result in an enormous cost to future generations. Recognizing that, the Finance Minister’s April 16th, 2024, budget promised to move away from tax and spend policies to focus attention on managing a bloated deficit. The plan was to make certain that the deficit would not exceed 1% of GDP and that it would begin to decline starting in 2026/27 fiscal year.

Fast forward to December 16th, when Finance Minister Chrystia Freeland was supposed to deliver a fiscal update to the House of Commons. Leading up to the slated update, the Prime Minister pushed a strategy to buy votes… ugh, help working Canadians, with a GST holiday and a $250 cheque for every working Canadian who made less than $150,000 in the 2024 tax year.

Surprisingly, that largesse was not enough to appease the NDP, the only party that was willing to support the package and only then, if it expanded to Include more Canadians. Apparently adding $6 billion to the deficit was not enough.

The impact these giveaways would have on the deficit did not include the costs associated with beefing up border security on the heels of President Trump’s tariff threats. When the dust settles, Freeland’s initial $40 billion shortfall was reset in the fiscal update and now comes in above $60 billion.

The Blockbuster News

Before Freeland was scheduled to deliver her fiscal update, she resigned her post as Finance Minister. In her resignation letter, posted on Freeland’s X account on the morning of December 16th , Freeland said Trudeau told her on the previous Friday that he no longer wanted her to serve as his finance minister and offered her another cabinet role that she declined. Freeland will sit as a Liberal member and plans to run again in her Toronto riding.

She posted her resignation letter on X and the text buoyed the broadly reported position that there was a widening chasm between the Prime Minister’s Office and the Department of Finance. Freeland called the U.S. president-elect’s threatened tariffs of 25% on Canadian products a “grave challenge” that needed to be taken seriously. “That means keeping our fiscal powder dry today, so we have the reserves we may need for a coming tariff war. That means eschewing costly political gimmicks, which we can ill afford, and which make Canadians doubt that we recognize the gravity of the moment.”

So where does that leave Canada?

No guarantees of course, but from our perch, we think Freeland’s resignation is the tip of an iceberg that will lead to a mutiny akin to what we saw with Joe Biden after his disastrous debate performance against President-elect Trump. Trudeau’s popularity has plunged to the point that if a federal election were held today, polls project a wipeout for his Liberal Party.

We think, given that backdrop, the government will fall, and Trudeau will be forced to resign. A spring election is a high probability, and we suspect that Mark Carney will enter the race to become Prime Minister as the Liberal’s make haste to set up a leadership convention.

In our view, and this is not a political endorsement, we believe that policymakers will conclude that Carney will be their best chance to turn the Liberal ship and at a minimum, compete effectively during the next election. If Trudeau does not resign – again… not a political endorsement – the Liberal party is toast!

One would like to imagine that 2025 will be the best of times for Canada but given the multitude of crosswinds emerging domestically and from abroad, Canada will have to make dramatic changes to the way it manages finances to prevent itself from falling temporarily at least, into a worst of times scenario.

IS SANTA CLAUS COMING TO BAY AND WALL STREET?

While Santa Claus can be counted on to deliver the presents on Christmas, the stock market cannot be relied upon for gifts. The Christmas season spotlights an entrenched seasonal pattern.

Historically, the Christmas break shepherds in a seasonal trend known as the Santa Claus rally. This seasonal pattern marks a period of upward momentum that typically occurs between December 26th and January 2nd.

Initially Identified by Yale Hirsch, founder of the Stock Trader’s Almanac, which introduced the concept of statistically predictable market phenomena such as the “Presidential Election Year Cycle”, “January Barometer,” and the “Santa Claus Rally.”

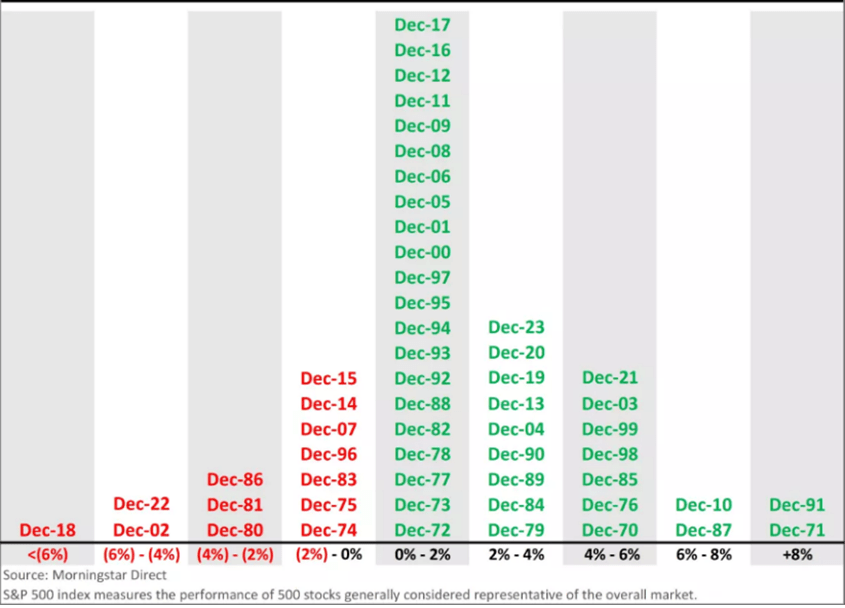

The Santa Claus Rally phenomenon has historically, served up decent returns. Stock prices have risen about 80% of the time with the S&P 500 index on average, returning 1.4% during this seven-day window.

Theories that explain a Santa Claus rally include momentum propelled by investor optimism, holiday spending, putting year-end bonuses to work and tax-loss harvesting steered by retail investors who tend to have a bullish bias. Institutional investors typically balance their books before Christmas and vacation over the Christmas break. Which is why we tend to see lower trading volumes and higher volatility during this period.

Some analysts have suggested that despite the historical trends, a Santa Claus rally may not occur in 2024. For one thing it is unlikely that many retail investors will have sizeable losses to harvest. As well, we think most investors have already established positions which will dampen additional buying, although we will not likely see excessive selling either.

Whatever the outcome, it is one of the interesting trends to watch as it sets up another seasonal pattern known as the January Effect. According to Hirsch, the first two trading days in January are included in the Santa Claus rally time period as the January Effect causes investors to buy stocks in anticipation of the rise in stock prices during the month. Some research points to value stocks outperforming growth stocks in December, although that was not what happened in 2024.

Many traders pay attention to cyclical trends and find ways to exploit historical patterns. But it’s always a relatively random proposition, and the Santa Claus rally is no exception. Investors monitor their risk and reward via position-sizing and stop orders if positions go against them.

Observing the Santa Claus rally is well documented, but trying to trade the phenomenon is another matter. Investors should be mindful of rules in trading during this period. Strategies may include a stop-loss level and a plan for what to do if the trade is neither profitable or stopped out by Christmas.

The Santa Claus rally often creates a favorable environment for sectors driven by consumer spending and positive investor sentiment. Retail and technology sectors typically see the most significant gains, while sectors like energy can experience mixed results depending on external factors.

For buy-and-hold investors and those saving for retirement, the Santa Claus rally does little to help or harm over the long term. It is a news headline happening on the periphery but not a reason to become more bullish or bearish during seasonal movements.

The January Effect is a theory that claims returns experienced in the January stock market predict the performance of the market for the remainder of the year. Again, no guarantees, which is why in our view, long-term investors should view holiday-season price action for what it is: A toss-up amid low market liquidity, with little or no predictive power for the coming weeks.

End-of-quarter and end-of-year position adjustments can produce highly volatile market movements. While some pundits see it as a Santa Claus rally or the beginning of the January Effect, we always consider the impact based on individual goals and risk tolerance before engaging in any seasonal trend.

Richard N Croft

Chief Investment Officer