When we think about value stocks, we think low price to earnings multiples and above average dividends. It makes value stocks ideal candidates for retirees seeking regular income with limited downside variability.

Value stocks also tend to out-perform the broad market over time. From 1977 through 2023, stocks paying above average dividends generated a total average return of 13.6% or about 30% more than the 10.1% return generated by the broad Canadian stock market (data from Norman Rothery of StingyInvestor.com).

Value investing has a storied history that began with Benjamin Graham’s 1934 book titled Security Analysis. It was re-released years later under the title The Intelligent Investor which became a best-seller.

Graham has often been referred to as the “father of value investing,” and his approach to finding value has transformed stock selection across a broad swath of managers. The most notable of these being Warren Buffett, who is considered by many as the greatest manager of our generation.

The back story is relevant because more recently, value stocks have taken a back seat to other investment approaches (i.e., growth and momentum strategies). This has given pause to investors who rely on solid companies that provide regular income for life’s necessities.

Looking at some of the biggest Canadian dividend funds, such as the iShares Canadian Dividend Aristocrats ETF (TSX: CDZ) and BMO Canadian Dividend ETF (TSX: ZDV), we find they have underperformed the S&P/TSX 60 Index Fund (TSX: XIU).

Even some of the noteworthy dividend payers like BCE Inc., TC Energy Corp., and Toronto Dominion Bank are trading below their pre-pandemic levels. Even with dividends included, their performance has been underwhelming. Notwithstanding the company specific events that impacted these stocks.

So, what happened? Certainly, the unprecedented rise in interest rates that began in 2022 was a factor. In a rising rate environment, a more competitive payout from bonds and guaranteed investment certificates dampened the appeal of dividend payers.

But that’s not the entire story because theoretically, higher bond yields should also negatively impact growth stocks. Presumably, fixed income assets become an attractive alternative for risk-averse investors, which causes a re-allocation of capital away from growth to safer higher yielding options. Higher rate, lower risk substitutes also increase the discounted cash flow (DCF) models, which reduces the present value of future earnings, thereby lowering the price one is willing to pay for growth.

Higher rates increase the cost of capital which impacts growth companies that rely on leverage to generate above average returns. Higher rates not only squeeze profit margins but also cause growth companies to scale back investment projects, research and development and expansion plans.

The final component is the macro impact of higher rates. Typically, rising rates are designed to slow economic activity and dampen inflation expectations. Growth stocks rely on robust economic activity (e.g., technology, consumer discretionary), and usually suffer as economic growth prospects dim. And there lies the rub! The US continues to experience above-trend growth despite higher yield, which has allowed earnings among growth stock to outpace expectations.

Given that last point, value stocks have not received the bump history would suggest. Since the pandemic, the supposedly reliable Canadian dividend stocks have underperformed riskier growth stocks.

It is possible that we are witnessing in Canada, a marked shift in sentiment. We are talking specifically about the Canadian experience where value-oriented dividend payers are concentrated in a few sectors notably the financial (i.e., Canadian banks) and telecom (BCE, Rogers, Telus) sectors. Is it possible that Canadian banks and telecoms have limited growth opportunities?

Canada’s big six banks have saturated the domestic market. Future expansion possibilities in this very mature market now seem limited; unless a bank buys a large competitor (note Royal Banks acquisition of HSBC) or attempts to expand internationally. The latter is fought with challenges as witnessed with Toronto Dominion Bank’s US money laundering disaster.

Making a bull case for the banking sector will come down to increased immigration, that should increase their deposit base. But you must lend out that newfound capital, which tends to elevate credit risk.

The telecom sector is even more reliant on immigration because international expansion faces competitive hurdles with minimum upside. Domestically, the big three telecom providers can only grow by poaching clients from their competitors. This strategy is tenuous at best and over time will have a negative impact on their ability to pay hefty dividends.

To spotlight this concern, one needs to look no further than BCE Inc. The company is facing questions about its ability to sustain its above average dividend. At the very least, the market expects BCE to freeze its current payout. The worst case is a dividend cut to preserve capital. For the record, we do not think Canadian banks with their strong balance sheets will freeze or cut their dividends.

The upside is that this performance lag may be temporary. These sectors could turn things around by finding growth opportunities that are not currently visible. Although that is not our base case – particularly within the telecom sector – the potential for a beneficial black swan exists. If that low probability event transpires, value-oriented dividend payers could rise like a phoenix from the ashes to resume their market-beating position.

One can take solace that the value thesis has stood the test of time. From Benjamin Graham to Warren Buffet, this approach has delivered above-trend returns. And while returns may not reach the heights of the five decades plus from 1977 through 2023, value-oriented dividend paying stocks will retain their role as a lower risk alternative to the resulting variability that accompanies a portfolio of growth and momentum stocks.

Finally, it is worth noting that performance is not always tied to the share value of the underlying stocks. Retirees, for example, are more interested in receiving consistent cash that increases over time. The trick is to make certain that what was, will continue to be.

THE BANK OF CANADA PARADOX

Doesn’t seem that long ago when central banks started to aggressively hike interest rates. It was January 2022 to be specific, when inflation came in a 4.8% or twice the Bank of Canada’s (BOC) target rate. Before that year-end 2021 datapoint, central banks viewed inflation as transitory having more to do with supply chain disruptions buttressed by excess demand from the lifting of COVID restrictions and massive government stimulus programs.

Recognizing that they may have been late to the party, central banks began an aggressive rate hiking cycle that lasted until the fourth quarter of 2023. However, the rate hiking cycle did not begin with a roar but rather with a whimper. With 20-20 hindsight, the BOC January 26th, 2022, meeting was an inflection point. But rather than immediately transitioning to a more hawkish stance, the BOC decided to engage in moral suasion by signaling that a rate hike was likely at the next governor’s meeting some five weeks later.

We raise this point because it is instructive as to how the BOC approaches transitions. Assuming we are at another inflection point, the March 6th decision to leave rates unchanged and to continue monetary tightening may be a precursor to a rate cut at the June 5th meeting.

Inflation has been slowing for the previous four months and is currently well within the BOC’s target range. There is also political pressure as higher for longer interest rates have negatively impacted household spending and business investment. When you take all the data into consideration, one can argue that we are due for a rate cut. Based on current interest rate swaps, the markets have assigned an 80% probability of a June rate cut.

The legitimate concern is that a premature rate cut could ignite the Canadian housing market which by all accounts is spring-loaded. In that vein, delaying a rate cut until the July meeting is a distinct possibility because it will dampen home buyer enthusiasm during the spring buying season.

Another factor that cannot be underestimated is the fear quotient. The fact that central banks squandered the opportunity to get ahead of the inflation cycle in 2022 will hinder their migration to a more dovish stance.

The BOC is also cognizant of the elephant in the room which, for Canada, is the US Federal Reserve (FED). The FED is not expected to cut rates until September at the earliest. And that is not a forgone conclusion as the US economy is outperforming the other major industrialized economies. If the BOC cuts too aggressively, that could weaken the Canadian dollar pushing up prices for imported goods.

We are also mindful that central bankers are conservative by nature. They move methodically and tend to telegraph their intentions so that financial markets have time to adjust. Faced with the choice of keeping a lid on demand or causing an unintentional spike in inflation, most will opt for the former. Especially since many observers believe their slow initial reaction to inflation tarnished their reputations.

What we know is that predicting the next move by the BOC is surrounded by a large cone of uncertainty. Decisions are made after analyzing reams of data and unless you are in the room where it happens, no one knows how BOC governors will act. The best we can do is make educated guesses.

To that point, Canadians have endured the most aggressive tightening campaign since the inflation shocks of the 1980s. It is hard to square a 5% policy rate when inflation is waning, unemployment is rising, productivity is slumping, business insolvencies are on the rise and the economy is slowing. You would think the BOC has a clear path to rate cuts.

However, as a small player in the global village, any attempt to transition independently gives rise to a range of unintended consequences. And while growth projections are relevant, it is unlikely that the current economic malaise will slip into a recession.

It is also notable that mortgage delinquencies have been manageable and while unemployment has risen a full percentage point since the beginning of the year, it remains at a healthy 5.7% rate. These factors afford the BOC some latitude. The governors can await further economic data before moving off their current slow and steady course.

That approach is certainly being telegraphed by the BOC which has said that rate cuts will be slower than the cycle of rate hikes. That suggests that the initial rate cut will likely be 0.25%. Enough to signal a marked change in direction but not enough to benefit homeowners when renewing their mortgage.

The BOC also noted that borrowing costs will likely settle at rates that are higher than Canadians have been acclimatized to during the period from 2008 through the COVID pandemic. Taken together, we suspect the best we can hope for is that rates will ease by 0.75% by the end of 2024.

ARE CANADIAN BANKS TURNING THE CORNER

Canadian banks reported first quarter earnings during the last week of May and the numbers were mostly in line with expectations. The general view among analysts was that earnings for the big six Canadian banks would be about 10% below the comparable first quarter 2023. The actual earnings were down 8% from the first quarter 2023.

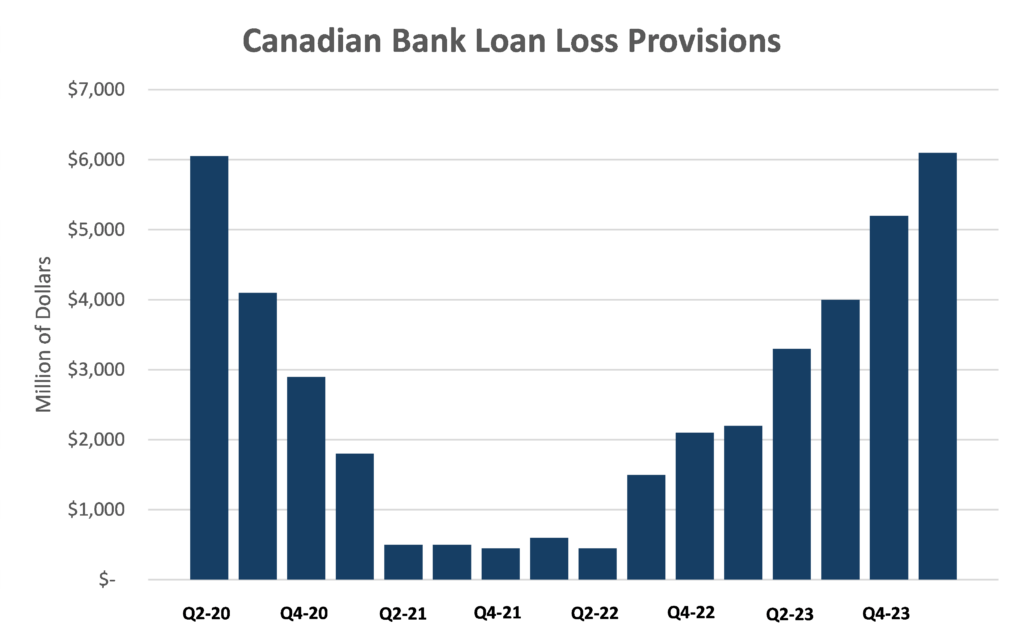

There were exceptions as Royal Bank and CIBC not only beat expectations but managed to top comparable first quarter 2023 results. In fact, Royal Bank announced a dividend increase and a stock buyback valued at $30 billion. Differences in profitability – which across the big six banks surpassed $14 billion – were the result of management decisions as to how much capital to set aside for loan loss provisions. These reserves that banks set aside to cover potentially bad loans, are at levels last seen during the pandemic.

Loan loss provisions are a significant factor when analyzing the banking sector. Capital that flows into reserves is taken directly out of profits. Simply put, if a bank earns say, $100 million in a quarter and management chooses to set aside $50 million to cover bad loans, the bank only reports $50 million in earnings.

Not only do loan loss provisions provide banks with a safety net, but they are also a useful tool for managing earnings expectations. In a reporting period where market participants have diminished expectations, excess reserves can be set aside without having a significant impact on stock performance.

The corollary to that is when rates begin to decline (see: The Bank of Canada Paradox) banks can begin pulling funds from their loan loss reserves which augments their profitability. We suspect that will happen in the reporting period immediately following the first rate cut.

Since markets are a forward-looking mechanism market traders are already pricing in above-trend expectations. We note than Canadian banks have rallied since the last quarter of 2023 and Royal and CIBC jumped nearly 5% on the day they released their first quarter 2024 results. Expect more of the same when the first rate cut, however small, takes place.

The surge in the share prices of Canadian banks has been a long time coming. It is something that we predicted late in 2023, where we talked about the many headwinds impacting commercial banks at the time, would become tailwinds at some point in 2024. In our view, we have reached that inflection point and believe that banks will deliver outsized returns through the remainder of 2024. We are looking for more and we have raised the probability of more buybacks.

There are risks of course. Notable among them being the challenges facing commercial real estate particularly within office space where stay-at-home work has had a significant impact. Fortunately, Canadian banks have minimal exposure to commercial real estate and longer term, we suspect there will be a return-to-work push at some point in 2024. We are already witnessing back-to-work guidelines across the US which means that is only a question of time until that strategy transitions into the Canadian labor market.

For our clients that are holding Canadian banks patience has been a valuable commodity. As the tide begins to turn, it is wise to remember that good things come to those who wait.

THE DOWNSIDE OF CANADA’S IMMIGRATION POLICY

On a percentage basis, Canada’s population is growing faster than any other member of the G-8 industrialized nations. The surge in immigration is the principal reason underpinning the housing crisis. Simply too many new people and not enough places to house them. The population grew by nearly 1.3 million last year, or 3.2 per cent, the quickest pace since the late 1950s.

As the housing crisis becomes more acute, the federal government has set in motion a series of measures to alleviate the pressure by limiting the number of newcomers to this country. The problem is one of timing. So far in 2024, population growth is accelerating because of the time lag between policy direction and implementation. Immigrants, made up almost entirely by international migration, want to get into the cue before the rules change.

The federal government intends to set limits on temporary residents, starting this fall. The government is trying to lower this group to 5 per cent of the total population over the next three years. Currently, new arrivals account for 6.5 per cent of the population. The hope is that said population growth could eventually slow to around 1 per cent as these new rules come into effect.

Over the first four months of 2024, the population aged 15 and older rose by roughly 411,000 – up nearly 50 per cent from the four-month increase to start 2023, according to Statistics Canada’s Labour Force Survey. Evidence that Canada’s growth has remained robust to start the year, complicating efforts by the federal government to limit migration.

Above trend immigration is not all bad. We could argue that the sizeable increase in the pool of labour has been a key reason why Canada’s inflation rate is below the US rate. The real issue is the short to medium term impact this influx of immigrants is having on the real estate sector.

Investment Implications

What we know is that immigration is good and bad. The surge in the labour pool will help the Bank of Canada rein in the inflationary impact of higher wages. That should prevent an uncontrolled wage price spiral and allow the Bank of Canada to separate itself from the US Federal Reserve’s “higher-rates-for-longer” stance by embarking on a made in Canada interest rate strategy. In short, more rate cuts sooner.

On the other hand, the impact on housing will remain a serious issue that has political implications. We suspect that is one of the reasons why the Liberal party is down in the polls. Assuming the Bank of Canada engages in preemptive rate cuts, it will likely spark an increase in residential housing prices, which could mitigate any benefit that would come from lower mortgage payments.

Longer term we anticipate that new home construction together with immigration limits will eventually bring the real estate market into equilibrium. It will simply take time.

Richard N Croft

Chief Investment Officer