COULD CHINA’S ECONOMY COLLAPSE

Is China on the precipice of an economic collapse? The world’s second biggest economy faces several hurdles, not the least of which is the trickle-down effects from a property sector plagued by excess leverage. This is especially disturbing because real estate influences about 29% of China’s GDP. At a minimum we suspect the fallout from insolvent Chinese developers will mutate into a protracted period of stagflation with global implications.

Hong Kong-listed shares of Country Garden, the largest developer of residential property in China was the latest shoe to drop in this Greek tragedy. The company reported a record loss of US $7 billion in the first half of this year and confirmed to shareholders that it is teetering on the brink of default.

Country Garden is facing substantial challenges weighed down by more than US $200 billion in debt. That is just slightly below the liabilities of Evergrande that recently filed for bankruptcy protection. The poor performance of Country Garden’s stock masks the personal anxieties of individuals who cannot take delivery of unfinished homes and will probably forfeit their down payments.

The biggest challenge is that many customers with incomplete projects will stop making payments which is the foundation on which China’s real estate is funded. In China, unlike in other countries, most people buy homes in advance and wait for their delivery and recent estimates put that number over one million homes.

According to recent commentary on CNBC, “Country Garden’s woes are compounded by the 4 Ds affecting the Chinese economy. These Ds are the country’s debt, decoupling, demographics, and demand.” Debt being the major concern as the slowing Chinese economy has caused much of the population to focus on debt reduction.

Youth unemployment is also a major concern. The latest data showed that China’s unemployment rate among young workers was greater than 21%. Much of that was the result of Beijing’s crack down on big tech companies, which until recently were a significant source of jobs for university educated Chinese youth.

The numbers are so bad, that China is no longer releasing the data. The rationale for discontinuing the data according to the National Bureau of Statistics was a need to “optimize” the survey approach since most of those urban youths aged 16 to 24 are still studying. That may be true, but the fact the Chinese Communist Party (CCP) decided to hide the data suggests that the numbers are getting worse… not better.

This is not the first time Beijing has restricted access to politically inconvenient economic data. Similar fallout can be found in other statistics relied upon by foreign investors. Data such as bond transactions and corporate registration data are not being made available. A sign of further deterioration.

Anecdotally, as recently as June 2023, the CCP banned three prominent finance writers from posting on the microblogging site Weibo because they had negatively commented on the country’s stock market and unemployment rate.

Commentary from outside China notes that the CCP regards the rise in jobless rates as a threat to its rule. Speculation abounds that officials responsible for publishing the data may have called off the report due to worries about their positions being at risk.

A similar effect can be found in data being released from Chinese universities where “false graduate employment reports,” may be inflating the data to meet government expectations. Despite this fake news narrative, it is apparent that the employment situation for young people is dire.

In a recent interview with DW.com, Liu Ye, a senior lecturer in international development at King’s College London noted that “Unemployment and underemployment / over-qualifications among graduates are the evil twins of the mismatch between the supply of the degrees and growth of graduate jobs.”

The chasm between heightened expectations and the dire reality has given rise to a defeatist attitude among millennials that has morphed into passive resistance to excessive work. Many millennials are choosing to live with their parents and get paid for house chores as “full-time children.”

In what seems to be standard operating procedure for the CCP, rather than admitting the shortfall of centralized economic planning, the response is to lay the blame on millennials by asking them to reset expectations and stop being picky about job choices.

In May, President Xi Jinping was quoted in China Daily, an English-language daily newspaper owned by the Central Propaganda Department of the CCP, to encourage millennials to consider manual work in the countryside and learn to “eat bitterness” — a colloquial expression that means to endure hardships. A somewhat cynical response considering that it does not fit the narrative espoused by the CCP for the last twenty years. Reading between the lines, it seems apparent that the CCP is running out of options.

That’s not to suggest that the Chinese economy will fall off a cliff. But it will require some out of the box thinking to counteract the economic headwinds. Boosting domestic consumption would be a good starting point, as China’s GDP is too dependent on exports.

At present, exports represent 18.5% of China’s GDP. However, that number is declining as geopolitical tensions and supply chain challenges have forced western economies to develop domestic manufacturing facilities. The bottom line is that any attempt to boost domestic consumption within China, much of which comes from investments in real estate, is challenging in a centralized economy. Not to mention the difficulties of domestic politics where making those changes requires encountering and overcoming some entrenched political interests within the CCP.

Another consideration is the massive debt load permeating through the Chinese economy. The debt crisis has spread through the corporate, local government, and household sectors. Effectively, the economy has transitioned into a balance sheet recession, at a time when these entities are focusing on debt reduction.

The revenue flowing to local governments has dwindled as real estate transactions slow and that trajectory will not likely change as companies like Country Garden and Evergrande face insolvency.

Foreign investments are also on decline as India becomes the preferred choice for cheap labor with up-to-date manufacturing facilities. Political uncertainty is also a headwind. Foreign investors are concerned given the CCP’s history of punishing foreign companies when their governments point out human rights abuses. These issues have major consequences associated with foreign direct investment (FDI) forcing US companies to diversify their supply lines. Not surprisingly, Mexico has been a major beneficiary of this sea of change.

Finally, China faces serious demographic challenges. Recent data confirms that the country’s fertility rate plunged to the lowest level on record. The rate dropped to 1.09 from 1.30 in 2020. The twin anchors of a falling and aging population pose a major challenge for the economy.

Perhaps the best gauge of just how serious the challenge is can be found in the CCP’s attempts to deflect public opinion. The CCP is utilizing the political edition of the “Great Escape” by waving a magical wand to make policy missteps disappear faster than you can say “abracadabra.” When all else fails, the desire to stay in power requires one to open the deflection playbook.

The CCP principal tool is to use their control over the media to find scapegoats. Flouting nationalistic rhetoric to blame job seeking millennial attitudes was the first volley, followed closely by citing foreign malfeasance like Japan’s decision to pump radioactive water from the Fujinami nuclear disaster into the sea. It doesn’t matter that China has been doing the same thing for decades and that the water from Chinese nuclear facilities is more radioactive than the current water being disposed of by Japan. In the deflection playbook, truth is the first casualty.

As China ramps up its finger pointing, one must read between the lines. As a rule, the number of scapegoating editorials will be directly linked to the inability of central planning to advance appropriate responses to multiple economic challenges. In that scenario, China’s downward spiral will likely continue which means the Chinese financial markets will languish. While the Chinese economy may not collapse, it could succumb to a protracted Japanese style period of stagflation.

CAN ARTIFICIAL INTELLIGENCE (AI) ENHANCE PRODUCTIVITY?

I read several commentaries from analysts debating the impact the recent settlement between UPS and its permanent delivery drivers would have on the company’s profit margins. Clearly the settlement was beyond the boundaries of normalcy as UPS full-time drivers are expected to earn US $170,000 annually at the end of the contract’s four-year term.

We are witnessing similar settlements across a myriad of sectors. The recent offer that producers put on the table for screen writers, and the recent settlements for transient nurses where incomes are expected to exceed US $200,000 annually (note there is no benefit package for transient workers) come to mind. And these settlements are likely to set a floor for autoworkers who begin their own negotiations in September. For the record, autoworkers are looking for a 40%+ boost in their compensation packages.

These actual and potential settlements have muddied the water in terms of central bank policy. As noted by Fed Chair Powell during his Jackson Hole speech in late August: “The central bank is navigating by the stars under cloudy skies.”

We take that to mean that rates will remain higher for longer based on two factors; 1) current inflation data has slowed but remains well-above the Fed’s target and, 2) fears that exaggerated wage settlements will lead to a domino effect where inflation becomes entrenched.

To what degree out-of-the-norm wage settlements impact inflation will hinge on whether the heightened payouts are ultimately accompanied by a commensurate increase in productivity. If productivity output offsets wage inputs, it will soften the inflationary impact.

This is where artificial intelligence (AI) can play a pivotal role. The plan for CFO’s charged with piloting companies through the labyrinth of outsized wage settlements, is the expectation that AI can alter the productivity paradigm. The objective is to have AI generate algorithms that transition the fallout from a questionable labor settlement into a magical eight-ball that enhances a company’s financial future.

To amend the productivity paradigm, CFOs must effectively integrate AI into various processes that over time will streamline operations (for UPS read: logistical support) and improve efficiencies. To appreciate how AI can offset the high costs of labor settlements management must redefine its understanding of what drives productivity. This thesis is critical for corporate America to counter the consequences of entrenched inflation.

Fortunately, AI can process and analyze vast amounts of data effectively revolutionizing decision-making processes across industries. Enhanced logistical support allows UPS drivers to deliver more goods, diagnostic tools (scanning medical records and genetic data) let nurses personalize treatment plans that can be approved by the attending physician. Screenwriters can produce more scripts using Chat GTP, farmers can generate better crop yields through AI-driven analytics. The list and potential are endless.

Perhaps the greatest advantage of AI is its ability to automate repetitive tasks which are time-consuming and prone to errors. Automobile manufacturing has embraced robotics and AI to automate assembly lines, resulting in increased production with fewer miscalculations liberating the work force to focus on higher value tasks that require creativity, critical thinking, and problem-solving. Think of Tesla’s assembly lines where higher paid engineers focus on the systems that assemble the cars that have enhanced its profit margins. Look for automakers to develop more repetitive systems that can offset future wage settlements.

Proponents of AI have also weighed in on the perception that it will replace human creativity. They argue that rather than replace creativity, AI augments human creative capabilities by using algorithms that analyze data patterns generating insights that humans might have overlooked. Think of the benefits this will have on art, music, and design.

Imagine AI-generated algorithms that help architects design aesthetically pleasing and structurally sound buildings. Content creation can be enhanced with AI tools that help writers, artists, and musicians generate new ideas that speed up the creative process.

AI’s ability to understand and predict user preferences has led to the delivery of highly personalized experiences across various sectors such as e-commerce, entertainment, and marketing. Meta Platforms and Google are at the forefront of this effort using AI algorithms to recommend products, content, or services that align with individual preferences. Certainly, being able to deliver machine generated personalized output comes with short term pain as job losses at the aforementioned companies have been significant.

That said, one cannot deny the fact that personalization leads to a more efficient use of time and resources for consumers. Streaming platforms employing AI to curate content recommendations, allows users to discover relevant shows or movies quickly. AI-powered email filters prioritize messages, reducing the time spent sifting through irrelevant communications. These personalized experiences ensure that users are directed towards tasks and activities that are most relevant to them, which theoretically optimizes their productivity.

The influence of AI on productivity is undeniably transformative and multidimensional. From enhancing data analysis and decision-making to automating repetitive tasks, personalizing experiences, and fostering innovation, AI’s impact has revolutionized the way industries operate and manage the productivity paradigm. As AI evolves, its potential to drive productivity gains and profit margins will undoubtably expand. To understand the impact these changes will have on inflation will require a longer-term cost-benefit analysis across the entire economy. The question is whether central bankers see it this way.

SEASONAL PATTERNS

Much as the seasons impact fashion trends, financial markets are subjected to price patterns that occur more often than mere coincidence might suggest. Think of this as Bay Street’s version of the Farmer’s Almanac where analysts offer short to medium term trading ideas based on oft-repeated seasonal patterns. In short, the financial market has its own set of seasonal trends that often have no discernable rationale. But when you roll back the covers, it’s clear that seasonal patterns are anomalies where stock prices are propelled by the whims of market participants rather than any change in the fundamentals underpinning a company’s economic value.

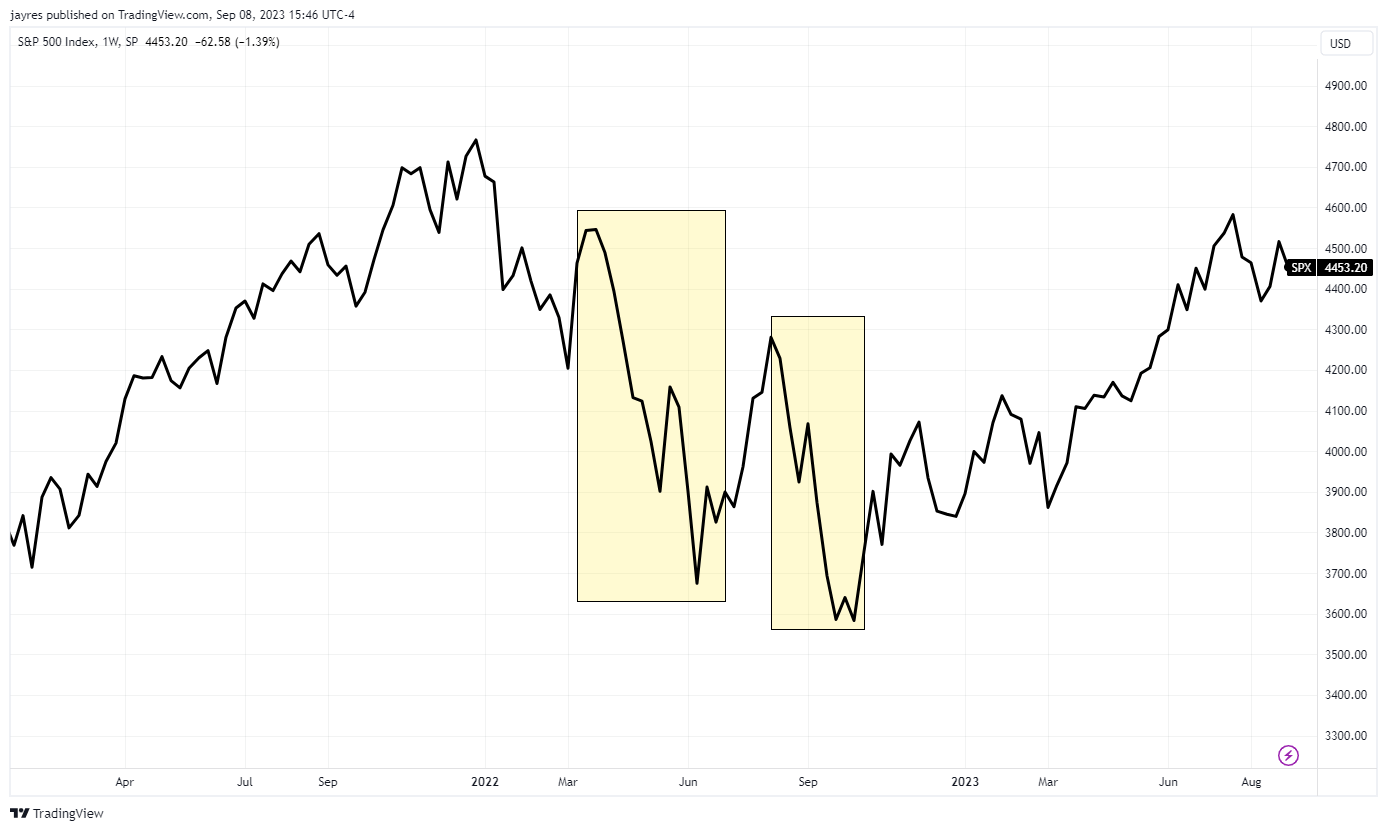

For example, certain months tend to be weaker because of 1) lower trading volumes, 2) “what-was-will-continue-to-be” folklore, 3) tax planning and 4) institutional window dressing. We saw this unfold in August resulting in a 5% correction in the S&P 500 index, with slightly more fallout in the Nasdaq which has a heavier tech weighting.

The August through September cycle tends to be one of the weaker periods for stocks. The rationale, according to some analysts, is that market participants are on vacation during August leading to lower trading volumes which tends to reduce liquidity and enhance volatility. The trend continues into September, as investors returning from vacation reassess their portfolios and make changes when liquidity is in short supply. The “sell-in-May-and-go-away” folklore follows the same logic (or illogic) and reveals the fickleness of investor sentiment. Historically, the summer months have shown lower returns compared to the rest of the year. But the impact is typically short-lived, as performance begins to normalize in November.

The January effect has two tracks that impact investor behavior. The first is related to tax selling that tends to take place in late December, as investors crystallize their losses. Those sales tend to propel new purchases in early January. This does not occur as often as one might expect which leads to the second track associated with the January effect, specifically that the performance of stocks at the beginning of the year often sets the stage for the market’s performance throughout the remainder of the year. Additionally, some portfolio managers engage in “window dressing,” where they buy better-performing stocks to showcase in their year-end reports. The window dressing phenomenon also occurs on a quarterly basis as underperforming managers reset their portfolios to assuage investors.

Another twist occurs during holidays, particularly after US Thanksgiving through to Christmas (the so-called Santa Clause rally). This is often associated with consumer spending patterns that tend to increase during the holiday season (i.e., Black Friday and Cyber Monday) combined with optimism for the new year. The idea that we may get interest rate cuts in 2024, will likely propel an above average holiday trend in 2023.

One of the more profound trends occurs during earnings season which tends to propel stocks that have a large analyst following. This pattern reflects corporate fundamentals more than the other trends because better than expected quarterly earnings can have a profound impact on a company’s value.

Energy and Commodity sectors can experience fluctuations caused by weather which impacts demand (e.g., colder winters increasing demand for heating oil and natural gas) and agricultural cycles that impact the farming community (e.g., how frost impacts the cost of frozen concentrated orange juice).

While seasonal patterns are ingrained in the investor’s psyche, they represent historical precedence not a forgone conclusion. Sectors can be influenced by a host of factors unrelated to seasonal patterns. As such, seasonal patterns are valuable signposts, they are not hitching posts.

EMBRACING UNCERTAINTY

There is a prevailing view among economists that North American stock markets have not only exceeded expectations for 2023 but are setting up for a serious downturn. The plethora of such commentary is not surprising since many analysts think the markets are nearing bubble territory. Some have gone so far as to suggest that 2023 looks a lot like 1987 when a strong rally through the first nine months of the year set up the market collapse that occurred on Black Monday October 19th, 1987.

Other factors that support the crash view include Berkshire Hathaway’s net sale of US $8 billion in the first quarter of 2023. When knowledgeable investors like Warren Buffet are selling stocks to raise cash, it spotlights the question; what does he know that we don’t? Buffet has long believed that cash is king during a recession, the depth of which is questionable. The point is market participants are paying attention!

Kevin O’Leary of Shark Tank fame also weighed in on the possibility of financial chaos because the rapid rise in interest rates is battering the US economy. In his view a recession is imminent which could portend a stock market crash.

Record high credit card debt, and consumer angst don’t help. Neither did the second quarter GDP numbers for the US economy that, while good, were mainly the result of government stimulus programs like the inflation reduction act. And the market is not cheap by historical standards. In fact, today’s price to earnings multiple of the S&P 500 is above the 20.71 number plotted on July 29, 1987 just prior to the Black Monday collapse. These data points raise questions about the sustainability of continued stock market gains and underscore the 2023 crash thesis.

Certainly, investor sentiment is poised for a crash scenario based on a survey that Yale University’s Robert Shiller began conducting several decades ago. According to Mark Hulbert, writing in Market Watch, “Shiller distills his results into one number: the proportion of respondents who think there is a less-than-10% probability of a 1987-magnitude crash in the subsequent six months. According to the latest survey, that number is 33.9%.” That means 66.1% of investors believe that the risk is above 10% which, considering a decline of the magnitude that occurred in 1987, would be considered a black swan event, is worrisome. To that point, Hulbert noted that there has been a distinct uptrend in this percentage in recent years. In 2015 the 24-month moving average stood at 64%, versus 74% today — down only slightly from its high from last year of 77%.

Separating the wheat from the chaff, investors need to recognize that the actual probability of a crash is significantly less than the number that permeates within investor psyche. Hulbert notes that in reality, “the probability of a 1987-magnitude crash in the next several months is very tiny at just 0.33%.” The thesis is supported by Xavier Gabaix, a finance professor at Harvard University that along with three scientists at Boston University’s Center for Polymer Studies, published a paper several years ago in the Quarterly Journal of Economics titled “Institutional Investors and Stock Market Volatility,” The paper analyzed decades of US stock-market history and offered a formula that predicts the average frequency of stock-market crashes.

Hulbert fed into the researchers’ formula that encapsulated the probability of a one-day decline of 22.6% (that was how much the Dow Jones Industrial Average fell on Black Monday 1987) occurring in the next six months which produced a result of 0.33%. So, given that the probability of a 1987 style crash is so low, why do so many investors fear the possibility?

One factor may be that investor sentiment has soured having experienced two bear markets (i.e., periods where the markets declined more than 20% from peak to trough) since the onset of the pandemic (see three-year chart on S&P 500). Two meaningful declines in quick succession is rare and having gone through that has likely impaired the experienced investor’s long term outlook.

Notes Hulbert, of the 38 bear markets since 1900 only three times did two bear markets occur in such quick succession (see chart on following page). Two of those rapid successive declines occurred during the Great Depression, and the third took place in the early 1960s. It had been more than sixty years since two successive bear markets delivered the one-two punch that investors suffered recently.

Another 2015 study (Asymmetric Learning from Financial Information), authored by Camelia Kuhmen of the University of North Carolina in 2015, noted that there was a significant difference between how investors update their beliefs following losses compared to how they do that following gains.

This tendency, rooted deep in behavior finance is referred to as “loss aversion.” Think of it as a psychological brain cramp, which causes people to feel the pain of losses more intensely than the pleasure of gains. Not only are these biases widespread following periods of market unrest, it takes time to transition from despair to hopefulness even when markets are defying gravity.

To embrace uncertainty, we need to condense the time it takes to transition from despair to hopefulness with data that provides a reality check. For that undertaking, consider the Shiller crash-confidence index as our contrarian indicator.

Shiller’s monthly data since 2001 confirms that when investors are more worried about a market crash, stocks on average performed better over the subsequent one-three-and-five-year periods. That’s a powerful aphrodisiac for mitigating brain cramps.

Unlike most sentiment indicators that are used to predict short-term aberrations, Shiller’s crash-confidence index has longer-term predictive power. For crash conscious investors, take solace as the index is signaling above-trend performance over the next several years.

Richard N Croft

Chief Investment Officer