A bull market seems like that elusive dream where investors fantasize about the prospect of rising disposable income. Where optimism soars higher than Boeing’s Starliner spaceship… when it works! You can feel the unbridled optimism on the trading floors, brokers high-five each other like they’re watching Toronto in the Stanley Cup Finals. Which is apropos since bull markets are about as rare as Toronto in the Stanley Cup finals.

In a bull market, even the most mundane things become exhilarating. A 50 bp rate cut orchestrated by a more dovish US Federal Reserve sparked, what is affectionately referred to as a “relief rally.” And don’t ask… relief from what?

Option volume has spiked as day traders ride the bucking bull in search of lottery style gains. And when your option pays off, you don’t just fist pump; you break into a spontaneous moonwalk, because, hey, for the meme stock generation, the moon is the limit!

In the current environment, typical of bull markets, fundamentals be dammed because the technicians whose main claim to fame before computers, was that they knew where to buy graph paper cheap. Now they sit in front of computer screens ready to tap the “buy-on-the-dip” button.

Logic takes a back seat to greed. Retail investors with questionable math skills, rally around stock splits. In their mind, getting more shares is akin to Cinderella’s pumpkin carriage turning into a Tesla Cybertruck. But enough of the hyperbole. Let’s consider the facts.

The Elusive Soft Landing

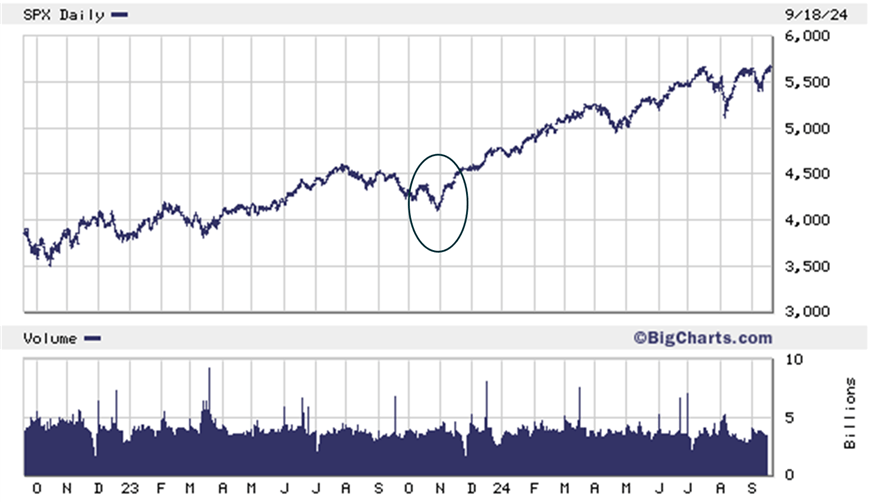

Since the lows of last November, North American financial markets have come alive like a phoenix rising from the ashes. The welcomed 50 bp rate cut by the Fed was really a cherry on top of the sundae. The real story is the marked change in the tone of Fed Speak.

Inflation may not be beaten, but it is moving in the right direction. And from a sentiment perspective, a dovish central bank implies that financial markets have an embedded put that will come to the rescue should a black swan event emerge. Say hello to the “risk-on” trade.

The back story is a spellbinding chronicle. The US Federal Reserve spent the last eighteen months in a quest to engineer a soft landing and by all accounts, they may succeed. Sure, the labour market is waning, but US joblessness remains in the range of full employment. The outsized September rate cut, according to Chairman Powell, was to ensure that the economy remained on solid footing. It was not set in motion to deal with an unexpected dot-plot.

Notes Deloitte Economic Research, we may be entering a golden era for labor markets. Much of the excitement surrounding the labor market hinges on increased productivity bolstered by investments in software and technology notably Generative Artificial Intelligence (AI).

If AI is as transformative as many believe that it will be, it has the potential to transform certain types of work. According to Deloitte, an optimistic view of the uptake and usefulness of new technologies could enhance productivity by an average of 1.8% per year from 2024 through 2028, well above the 1.5% baseline.

If you add above-trend population growth to the productivity dividend, that could have an exponential impact on economic growth. Especially if that increased population finds its way into the labour participation rate and the entrenched trend of workers delaying retirement continues. That combination leads to a domino effect as a larger more productive labour force leads to more output and consumption, that acts as a virtuous cycle that lifts the overall economy.

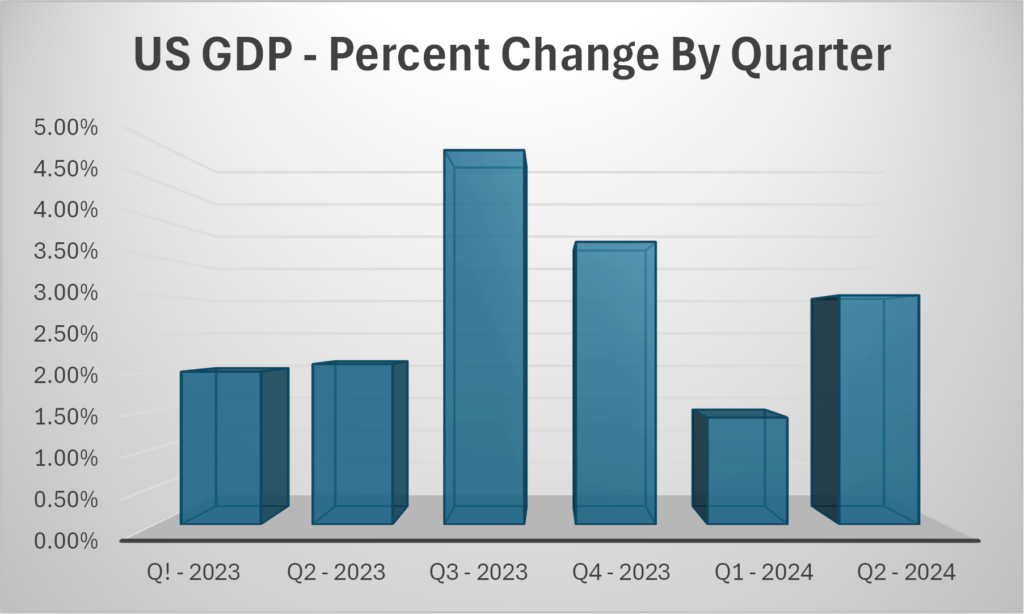

These dynamics may already be in play as seen in the most recent data from the US Bureau of Economic Analysis (BEA). According to the BEA, real gross domestic product (GDP) increased at an annual rate of 3.0% in the second quarter of 2024, according to the “revised” estimate. In the first quarter, real GDP increased 1.4%. The increase in the second quarter primarily reflected increases in consumer spending, topping up private inventory and business investment. Imports, which are a subtraction in the calculation of GDP, increased.

The long-term prospects for US suggest that GDP will rise above-trend through 2028 and perhaps beyond. Deloitte estimates that from 2024 through 2028, GDP will increase at an average annual rate of 2.5% per year, 0.5 percentage points higher than the baseline. “This scenario also results in higher long-term potential for the economy at 2.8%, compared to 2.2% in the baseline. In that sense, this scenario shows what it would take to make recent rates of economic growth sustainable in the long run.”

US Consumer Remains Healthy

Despite the political rhetoric, surveys seem to indicate that the US consumer is feeling good about the economy. Particularly among higher income participants who have benefitted from the wealth effect tied to higher stock prices and a tight real estate market. Not surprisingly, a majority of higher earning Americans surveyed, say that their financial position has improved over the past year. However, sentiment remains subdued or relatively unchanged for lower to middle income respondents.

Income is not the only factor that underpins consumer sentiment. According to one McKinsey survey, age, not income, seems to be the number one factor impacting consumer sentiment. According to McKinsey, “Gen Zers and millennials across income groups report higher rates of optimism compared with Gen Xers and baby boomers. This could be related to the long-term unemployment rate, since a higher percentage of Gen Xers are long-term unemployed, or unemployed for more than 27 weeks, than those in younger generations.”

According to McKinsey, another divergence among demographic groups stood out: “male respondents note higher levels of optimism (47 percent) compared with female respondents (37 percent). Levels of optimism increased relative to the second quarter for both groups, and the gap between male optimism and female optimism has held steady for the past year. Male respondents report feeling optimistic about an improved job market in the third quarter, while female respondents indicate feeling concerned over making ends meet.”

While price increases have receded from their 2022 peak, 53% of respondents point to higher prices as their main concern. That is likely a result of “inflation overhang” as consumers adjust to current price levels. History tells us that it takes twelve to twenty-four months to adjust to the new normal baseline even though inflation is stabilizing.

Not all consumers are slow to adapt as 37% of respondents say that stabilizing inflation has made them feel more optimistic about the economy, up from 31% in the previous quarter. As we transition into the holiday shopping season, some retailers are cutting prices on everyday items which may be why we are seeing this surge in optimism.

We note that, despite rising optimism, disposable income seems to be directed towards non-discretionary items such as entertainment, leisure travel and visits to restaurants. Within these categories, spending has surpassed 2021 levels. There remains concern about the rising cost of housing which may eventually rein in this spending pattern as consumers seek out cost-saving initiatives in the non-discretionary categories.

Politically Motivated Economic Pressures

Neither Presidential candidate is likely to short-circuit this bull market. The markets are of the view that a second term for President Trump would imply less regulation and lower taxes. Both of those factors are good for the market. On the other hand, Trump’s promise to “drill baby drill,” would likely have a negative impact on oil prices.

There is also concern that his across-the-board tariff strategy may be inflationary. Some in academia believe that putting large tariffs on imported goods may undo much of the work that the Fed orchestrated with their hawkish stand on interest rates.

The Trump camp counters that tariffs imposed on China back in 2019 had little impact on inflation. While that is true, it is because most of the tariffs were absorbed by US corporations and were not passed on to consumers. Whether corporate America would be willing to take the same hit this time is up for debate.

Neither side of the tariff debate will be good for stocks. If corporations absorb the price hit, it will negatively impact margins and ultimately earnings. If corporate America chooses to pass the costs through to the consumer that will likely lead to higher inflation.

Interestingly, both campaigns are aligned on trade. President Biden kept the tariffs in place that Trump initially put on China and both Harris and Trump are of the view that growing the economy domestically is more beneficial longer term.

Vice President Harris wants to provide new business startups with a $50,000 tax exemption. That is well-above the current $5,000 tax exemption which most agree is not meaningful. As Harris quipped in a recent town hall with Oprah Winfrey, the current $5,000 tax break was only enough to finance a concept of a business.

The Harris platform wants to embolden the middle class by offering tax breaks and childcare credits. The Democrats want to fund the middle-class tax breaks by increasing taxes on the wealthiest Americans in the name of tax fairness. So far, the financial markets believe that is a Democrat stretch goal that is unlikely to pass muster in Congress or the Senate.

The main concept underlying the “tax fairness” mantra is a questionable wealth tax. The idea is to tax the wealthiest Americans on the value of their assets. That is a chilling proposition that is fraught with unintended consequences not the least of which would be a mass exodus of the country’s elite talent. That aside, there are questions about how such a tax would even work.

What Comes Next

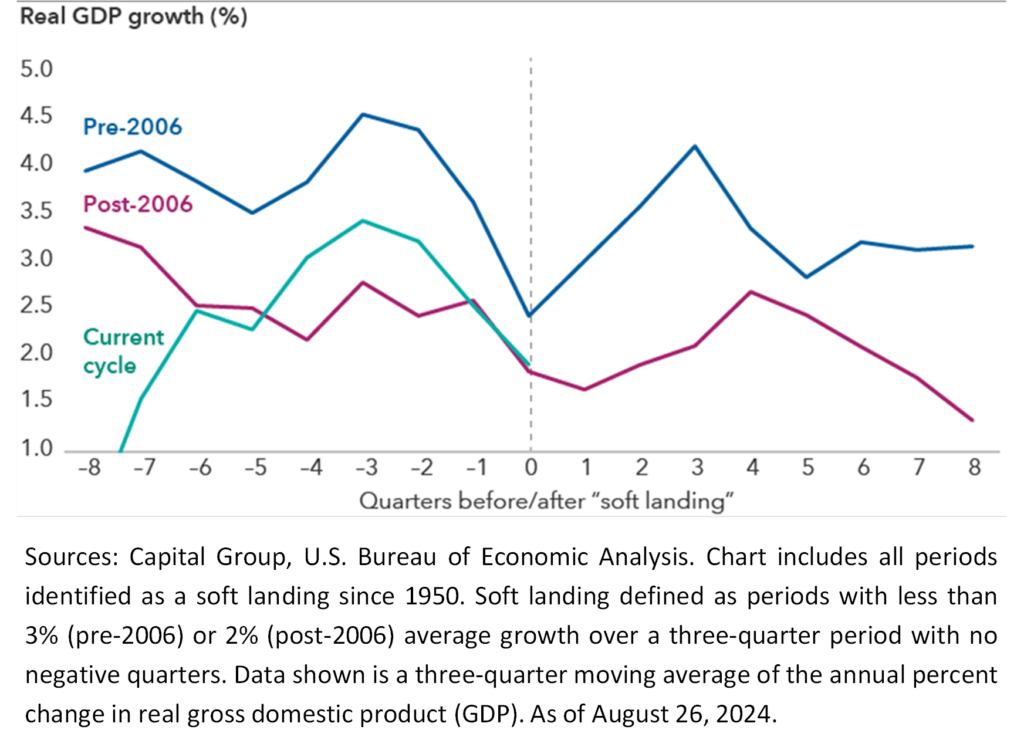

The bullish tone emanating from North American stock markets is premised on the soft-landing scenario. Although there is no official definition of a soft landing, it is considered for the purposes of this analysis to occur when real GDP growth expands, on average, for three quarters at a pace below the U.S. economy’s potential growth rate (currently 2.0% per the Congressional Budget Office’s estimate) with none of those quarters showing an outright contraction. If the U.S. economy grows at a 1.5% annualized rate in the third quarter of 2024 — the current consensus estimate — it will have met this definition of a soft landing.

This marks an important milestone because, when it has occurred historically, the economy has tended to accelerate in subsequent periods. This pattern could repeat in 2025, especially if the Fed continues to lower rates.

Capital Economics produced a line chart that illustrates U.S. real GDP growth during quarterly time periods before and after a soft landing during a pre-2006 period, post-2006 period and the current growth cycle. Overall, the chart shows that economic growth tends to accelerate for several quarters after a soft landing has occurred.

Historical Precedents

While nothing is guaranteed, history does offer some guidance about the potential trajectory of the economy and financial markets on the heels of a soft-landing. The tightening cycle that ended in 1995 being a case in point. After an aggressive rate hiking campaign, the Fed ultimately reached a terminal rate of 6.0% in 1995.

Despite that swift pace of pre-1995 rate hikes, the US economy bolstered by the exciting possibilities of the Internet, continued along a path of robust expansion through the year 2000. Along the way weathering multiple black swan events including foreign exchange upheavals (i.e., the Mexican peso crisis and the Thai Baht devaluation), the Russian debt default in August 1998 which ultimately lead to defaults in neighboring countries (including Ukraine’s debt default in September 1998) and the collapse of hedge fund Long-Term Capital Management.

Dealing with these black swan disruptions, the Fed made some nimble policy adjustments that looked a lot like an economic high wire act. With each subsequent move to lower and then raise rates, financial markets gyrated like a roller coaster not knowing whether the Fed would maintain balance or tumble into economic chaos. In the end, the economy survived despite an end of cycle rate of 6.75%.

According to Capital Economics, despite all the turmoil in the 1995 through 2000 era, “core inflation remained at or below the Fed’s 2.0% target. If the current cycle were to repeat the 1995 through 2000 turmoil, we would see a cycle-low Fed funds rate of 4.125% and an end-of-cycle rate of 5.875%.”

Unfortunately, the U.S. economy had more slack in 1995 that it does now. The US unemployment rate was 5.5% in 1995 eventually falling to 3.8% by the turn of the century. Today, US unemployment stands at 4.3%, so there could be less room for error. It is also possible that the same level of interest rates today exerts a greater drag on the economy than it did then because of higher debt levels and demographic changes.

On the positive side, government stimulus, initiatives to promote American made state of the art technology and massive expenditures on artificial intelligence by hyper-scalers, could mitigate the drag from higher interest rates. On that note, so far so good!

The U.S. economy does appear to be tolerating higher interest rates and, despite recent concerns new job openings continue to rise but at a much slower pace. The recent uptick in the US unemployment rate occurred despite the addition of 114,000 new jobs.

That is indicative of an economy where rising unemployment has more to do with an upward revision in the labor participation rate rather than a slowing of the job market. More to the point, this is precisely what Fed officials would like to see because it should moderate wage demands which short-circuits any notion of a wage price spiral.

Caveat emptor! If the economy reaccelerates and profits expand in 2025, it will probably increase demand for labor which could reignite wage demands.

Interest Rate Outlook

Based on our analysis of the interest rate futures market, investors expect the Fed to cut rates by an additional 50 bps by the end of this year and more than 100 bps in 2025. That is our base case, but given geo-political tensions and election uncertainty, we are mindful that a black swan event could occur before the end of 2025.

Which is to say, the bull is alive but any trajectory to higher levels will be choppy.

Richard N Croft

Chief Investment Officer