LANDSLIDE

First a caveat. As a proud Canadian, I have no skin in this game. Whatever one thinks about Donald Trump, does not change the fact he will be leading the US government for at least the next four years.

With that out of the way, one cannot deny that Donald J. Trump has completed a remarkable comeback. He won the Electoral College and the popular vote. The Republicans gained control of the Senate and Congress. It was by any definition, a landslide.

At the same time, he shunned pollsters who did not believe that an equally divided country would coalesce around a single issue… the economy. The economy was center stage, and the US electorate felt that it would be in better hands with President Trump. Whether that faith is rewarded time will tell.

But that was then, and this is now. It is time to separate the political rhetoric – i.e. mass deportation, weaponizing the Justice Department in search of retribution – to examine Trump’s economic agenda which one hopes is what he will focus on.

While Trump’s economic agenda lacks details, there are some certainties. The Trump tax cuts that were set to expire in 2025, will be extended and perhaps – depending on the will of Congress – be set into law.

On that point, it is important to understand that Congress is the legislative branch of government that controls tax and spending policies through negotiation with the Executive (i.e. the President) branch. To be etched into law, requires a congressional super-majority where at least 67% of Congress must support the plan. Any proposal that does not receive the super-majority must incorporate a sunset clause which is why the current Trump tax plans are set to expire in 2025.

There is little doubt that a Republican controlled Congress will support Trump’s efforts to cut personal and corporate taxes. He will probably also be able to enshrine his election promise to remove taxes on tips and social security benefits. That will be a windfall for the service sector and on a macro level, should increase consumer spending, enhance profit margins and expand p/e multiples into the foreseeable future.

The downside is that tax cuts will raise the debt level and possibly be inflationary. Trump believes he can offset the costs associated with these plans through a blanket tariff policy on manufactured goods coming into the country. Most economists believe that tariffs will not deliver the solution and the fallout from unintended consequences could be dire.

Tariffs are effectively a job creation mechanism. If tariffs impinge profit margins, companies will be encouraged to produce goods in America. But creating new skilled jobs can be expensive. How do you find skilled US workers to operate machinery in a tight labour market that will be exasperated by the deportation of millions of immigrant workers. Most likely, the bulk of any repatriated manufacturing jobs will be filled with robotics.

Tariffs can also be inflationary although that may not be a significant issue because 1) manufacturing represents about 30% of US GDP, and 2) tariffs have a one-time impact but don’t have any real impact on future price increases.

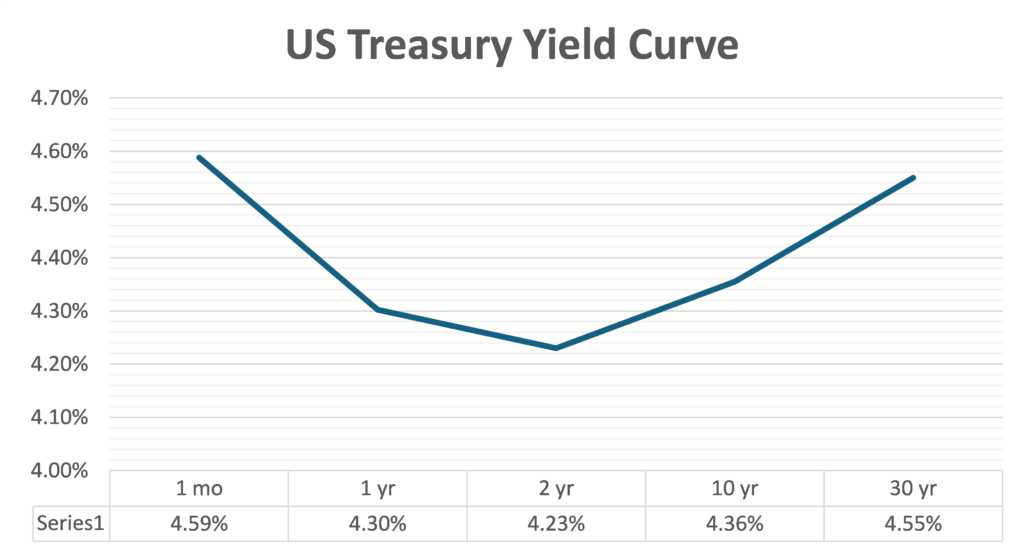

That said, we are seeing some pushback in the US Treasury market as yields on ten-year bonds jumped 15 basis points on November 6th. That’s important because ten-year rates are the benchmark for most private sector transactions. We will likely see 7% 30-year mortgages soon which will impede housing affordability and dampen enthusiasm for US homebuilders.

Higher rates also impinge the cost of government which limits the administration’s ability to tackle the federal debt. And that’s not likely to change. No matter how much waste the newly created Department of Government Efficiency (DOGE) cuts from the government bureaucracy, it will not be enough to dent the US debt load. That’s because 90% of the US budget is non-discretionary spending tied to social security, the military and interest on the debt.

Mind you trying to manage the US debt load through a cost-cutting lens is a moot point. It will simply not work. The only way to manage the debt is to grow the economy at a faster pace (i.e. 3% +) than the interest costs associated with the debt.

There will be less regulation under a Trump presidency as he will likely dismantle many of the regulatory bodies that he believes creates friction within the economy. He is right to a point. The question is one of balance.

Take energy as a case in point. Trump’s plan to drill baby drill is designed to make America energy independent. However, removing environmental restrictions to fast track that goal could have an outsized impact on climate change. Which based on past comments, is not high on Trump’s priority list.

Cryptocurrencies like Bitcoin will do better under a Trump administration. Fueled by a reduction in regulatory hurdles and broader acceptance within the halls of government, Bitcoin is well on its way to the illusive USD $100,000 plateau.

We have some exposure to Bitcoin in our Conviction Equity Pool through an investment in MicroStrategy Incorporated (symbol MSTR). That might seem an odd way to play cryptocurrencies, since the company provides global artificial intelligence-powered enterprise analytics software. The back story however, is that MSTR’s multi-billion dollar balance sheet is almost entirely invested in Bitcoin.

Canadians will be impacted by many of Trump’s policies although we will not see much until sometime in 2025. President Trump will want to revisit the USMCA trade agreement that can be re-opened in 2026. I suspect a Trump administration will take a hard line on renegotiating the agreement, although he is unlikely to suggest it is a “really” bad deal since he negotiated the first one.

Typical of the Trump’s negotiating style, he will float some aggressive stretch goals and probably embark on some heavy-handed rhetoric about Canadians taking advantage of their American neighbours. I understand the tactic but many of his followers may not see it the same way. In the wrong hands, could we see embedded resentment rising against say… Canadian snowbirds?

Because our supply chains are so interconnected, the Canadian economy will get a spin-off benefit from robust US growth. On the other hand, we should anticipate a weaker Canadian dollar which will push up the cost for imported goods and make it more expensive for snowbirds to travel south for the winter. Point being, you might want to up your US dollar exposure.

Getting a second Trump Presidency for many Canadians may seem like being dealt a 7–2 off suit in a game of Texas Hold’em. Unfortunately, in the game of life, we must play the cards we are dealt.

TRUMP’S IMPACT ON CANADA

In 1969 Prime Minister Pierre Elliot Trudeau met with President Richard M Nixon. At the time he quipped that “living next to you is in some ways like sleeping with an elephant. No matter how friendly and even-tempered is the beast, if I can call it that, one is affected by every twitch and grunt.”

The policies being floated by the incoming US administration will have an outsized impact on the Canadian economy. Some good… some bad!

President-elect Trump wants to reduce corporate taxes which will have to be met by Canada lest we want to lose some of our best industries looking to boost their after-tax profits. Similarly, we may see a reduction in federal personal tax rates to remain competitive with the US.

If Pierre Poilievre wins the next election – a big assumption given the Liberals ability to pull the party out of the fire – we should get some tax relief. There is a train of thought that Mr. Poilievre may appeal to Trump because they share many of the same principles on how best to manage a capitalist economy.

If Trump sets in motion his blanket tariff policy, that will have a major impact on Canada. A blanket 10% tariff on Canadian manufactured goods would shrink the Canadian economy by $1,100 per person according to University of Calgary Professor Trevor Tombe. If across-the-board tariffs are made permanent it would almost certainly thrust Canada into a recession.

In late 2025 the US administration will begin the process of re-opening the USMCA. The first step in that process will be to “encourage” Canada to up its’ contribution to NATO. Canada is one of five NATO members that does not spend 2% of its GDP on defence. It is doubtful that we can sidestep this “encouragement” in search of a middle ground.

The potential economic dislocations cannot be understated. First, nearly 77% of Canadian exports flow to the US which is the highest level since 2007 and secondarily, any whiff that US trade representatives’ negotiation strategy will rely more on the stick rather than carrot approach, will put a chill on business investment in Canada, given the uncertainty about access to the U.S. market.

However, the news is not all bad. Some analysts see opportunities if Ottawa plays its cards right and steps up on a range of issues important to Washington. Notably as mentioned, military spending, migration, and cutting China out of electric vehicle and battery supply chains. It comes down to credibility and nice words will not be enough.

The Canadian government has been circling the wagons by reaching out to relationships it built with U.S. officials during the Trump 1.0 administration. On that point, there have been conflicting media reports that Mr. Trump is considering Robert Lighthizer as his U.S. trade representative. Mr. Lighthizer was Ms. Freeland’s counterpart during the renegotiation of the North American Free Trade Agreement. That could be good or bad… as familiarity can breed contempt. The good news is that a revival of the Lighthizer / Freeland round table means that the same personnel will be sitting in the same seats as in 2018. The bad news is that the table has changed.

If Canada wants to survive a USMCA give and take, it must approach this negotiation as a reliable partner in a North America trade bloc particularly when it comes to energy security which is high on Trump’s list of wants.

In a high stakes game of quid pro quo, Canada must ensure that it is part of a North American technology sector which will be critically important. In a sign of good faith, the federal government might want to think about rescinding the Digital Services Tax which has an outsized impact on US mega-tech companies.

We have made some moves that will appeal to the American psyche, notably the 100% tariff on Chinese EVs and 25% tariffs on Chinese steel and aluminum.

The real challenge for Canada’s trade relationships is a lack of viable alternatives. Past attempts to diversify trade away from the U.S. have come up short.

It’s not for want of trying. Canada has signed a series of free trade agreements over the past decade, including a deal with Korea in 2014, the European Union in 2016 and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), covering 11 countries, in 2018.

In absolute terms, exports to Asia have grown exponentially. Canadian companies have expanded in Southeast Asia and Japan, where agriculture tariffs are declining as part of the CPTPP.

But other markets haven’t developed as hoped. Companies are nervous to expand in China, given its tensions with the U.S., and the diplomatic spat between Canada and India over the killing of a Canadian citizen has made any two-way deal with India politically intolerable.

Then there is the issue of logistics. Global trade patterns hinge on the size of and distance between trading partners. You cannot expect that trade with say, England, will provide a viable alternative to the US.

With risk comes opportunity. Canadian representatives have been lobbying Republicans for more than a year to dampen the fallout from a possible Trump victory. Touting the advantages about what Canada can bring to the table has been well-received… so far.

If Canada can clear the deck (i.e., remove the digital sales tax and stop transshipment from China) before the start of negotiations, we would be in a more favourable position.

Reopening the USMCA could also provide an incentive for Ottawa to liberalize its agriculture sector by dismantling the supply management system that sets production quotas and prices for dairy farmers. The program infuriated the first Trump administration but, in the end, U.S. negotiators abandoned the issue. We doubt that will be the case this time. The federal government could offer to end supply management as a concession to get a better deal for Canada’s economy – with the added benefit of lowering dairy prices for Canadians.

That said, Canada’s economy braces for an ‘unpredictable’ future trying to negotiate with a trade partner at a time when their belief in trade is in question.

TAX REFORM IN CANADA

Under Trump 2.0, lower taxes for both U.S. businesses and individuals will be at the top of his agenda. Meanwhile, Prime Minister Justin Trudeau, despite introducing some cuts, has mostly raised taxes on businesses and individuals, including with his recent capital-gains tax hike.

Clearly, Canada and the United States are moving in opposite directions on tax policy. If the Canadian government is to prevent us falling off a competitive cliff, policy makers in Ottawa and across Canada will have to quickly enhance our tax competitiveness.

This will be important beyond our relationship with the US because Canada was already considered a high-tax country. Our top combined (federal and provincial) personal income tax rate, as represented by Ontario, ranked fifth highest among 38 high-income industrialized (OECD) countries on the most recent survey taken in 2022. And last year, Canadians in every province, across most of the income spectrum, faced higher personal income tax rates than Americans in nearly every US state.

Higher tax rates make it harder to attract and retain highly skilled workers, including doctors, engineers and entrepreneurs. High tax rates also reduce incentives to save, invest and start a business – all key drivers of prosperity.

To close the tax gap, the federal government should reduce personal income tax rates. One option is to reduce the top rate from 33 % back down to 29 % (the rate before the Trudeau government increased it). Simplification would also help. How about eliminating the three middle-income tax rates of 20.5%, 26% and 29%. Nearly all Canadians would face a personal federal income tax rate of 15 %, while top earners would pay a marginal tax rate of 29 %.

On business taxes, Canada’s rates are also higher than the global average. Canada was once competitive compared with the US, but that changed under Mr. Trump’s first administration, when he reduced federal corporate income taxes to the current level of 21%. That makes it difficult for Canada to attract business investment and corporate headquarters that provide well-paid jobs and enhance living standards.

And it could get worse. On the campaign trail, Trump said that he plans to lower the federal business tax rate from 21% to 20% and reduce it to 15% for companies that make their products in the US.

Changing US tax rates requires congressional approval, but with the House of Representatives and the Senate under Republican control, we can assume Trump will get what he wants. Barring any change in Canadian policy, business tax cuts in the US will intensify Canada’s net outflow of business investment and corporate headquarters to the US.

The federal government should respond by lowering Canada’s business tax rate to match that US rate wherever it lands. Moreover, Ottawa should (in co-ordination with the provinces) change tax policy to only tax business profits that are not reinvested in the company – that is, dividend payments, share buybacks and bonuses. This type of business taxation has helped supercharge the economy in Estonia. These reforms would encourage greater business investment and ultimately raise living standards for Canadians.

Finally, given Canada’s massive outflow of business investment, the government should (at a minimum) reverse the recent federal capital-gains hike.

Of course, there’s much to quibble with in Mr. Trump’s policies. For example, his tariffs will hurt the US economy (and likely Canada’s), and tax cuts without spending cuts and deficit reduction will simply defer tax hikes into the future. But while policy makers in Ottawa can’t control US policy, Mr. Trump’s tax plan will significantly exacerbate Canada’s competitiveness problem.

We can’t afford to sit idle and do nothing. Ottawa should act swiftly in co-ordination with the provinces and pursue bold, pro-growth tax reform for the benefit of Canadians.

GLOBAL IMPACT OF A TRUMP PRESIDENCY

The day after the election, stock and bond markets cast their first ballots on the next four years. Stocks went higher, as did long-term interest rates. The S&P 500 Index rose 2.5%, the Nasdaq Composite was up 3% and the small-cap Russell 2000 jumped by 5.8%. At the same time, US bonds sold off, with the benchmark 10-year US Treasury bond yield (yields move inversely to price) up by 0.15%, its biggest one-day rise since the spring.

Think of the financial markets as a kind of daily election. The immediate postelection rise in equities likely reflects investors betting on a future of higher corporate profits powered by lower business taxes, and higher economic growth through additional deficit stimulus. The rise in bond yields appears to be largely driven by the same thing: a bet that if Washington runs bigger deficits and pumps trillions of extra borrowed dollars into an economy at full employment, that spells higher inflation and the inevitable response of higher interest rates – which is diametrically opposite to US Federal Reserve policy goals for lower inflation and lower interest rates.

Taxes also play a role as many analysts take the position that tax cuts will increase profit margins. On day one, Trump will extend his 2017 tax cuts (they expire in 2025), but on the campaign trail he also talked about making Social Security pensions tax-free, removing income tax on tips and overtime pay and lowering business tax rates.

It is unclear what tax changes Mr. Trump will send to Congress, or what will pass. But with Republicans holding sway in the House of Representatives and a majority in the Senate for at least the next two years, it is a safe bet that the tax cuts will be implemented.

So, buckle up because the economy of a second Trump presidency could get wild – and not necessarily in a good way.

Tariffs will support domestic manufacturers, who will be able to meet the higher wage demands that will probably result from the reduced labour supply that tighter borders will bring. Higher wages will, in turn, support overall demand, prolonging the American economic expansion. Already, in anticipation of this, the stock market leapt to new record highs on Wednesday, as investors bought shares in companies they expect to thrive.

In that light, we anticipate that the Trump presidency will probably begin with an economic bang. In the short term, this will probably be good for the Canadian economy, since it will stir demand for exports, simply because the strong US dollar will make Canadian goods cheap south of the border. But look a bit further down the road, and the outlook starts to get murky.

Canada may face a peculiar set of challenges when its trade deal with the U.S. and Mexico comes up for renewal in 2026, as Mr. Trump will no doubt push for a harder bargain. But by then, an even bigger challenge may have arisen in the cycle of the U.S. economy. That’s because the measures that boost growth will provoke inflation, which is already running above the Federal Reserve’s target.

That rise in inflation was also anticipated in Wednesday’s market action: Although stocks and crypto surged – the latter because Mr. Trump went out of his way during the campaign to appeal to the sector – bond prices fell. That’s an indication that investors doubt the fiscal health of the government, and that has a big impact.

Falling bond prices translate into rising yields, which means the interest rate the US government must pay on its debt is going up. When interest rates on the government’s debt rise, they go up across the board.

Potentially worsening matters is that if Mr. Trump’s tax cuts become permanent, the impact on the fiscal deficit will put the national debt on an even sharper upward trajectory. The government will be forced to sell even more bonds to cover its expenses, flooding a market in which investors will demand ever-higher returns.

The eventual rise in interest rates will be proportionate to the scale of the preceding economic boom. The longer the boom continues, and the more asset prices rise, the higher interest rates are likely to go. That will create problems globally, since rising interest rates stateside will drag them higher elsewhere. Canada has already experienced this impact, with yields on government bonds rising alongside those of the United States, running against the course of the Bank of Canada’s easing policy.

That may eventually negatively impact the US. Higher interest rates will crimp economic recoveries, with European economies being especially vulnerable since they are already weak. Continued economic sluggishness in its trade partners will thus limit demand for American exports, which will complicate Mr. Trump’s aim to raise them.

Higher interest rates in the United States would eventually hamper growth there as well. With mortgage and credit-card rates rising, consumers will be forced to rein in their spending. Ultimately, a tipping point could come at which investors anticipate a slowdown and dump stocks, causing a market crash. Unless Mr. Trump moderates his stated plans once in office, the risk that this happens must be assumed. The question is whether the crash happens before or after Mr. Trump finishes his term.

But there is no question that this is the trajectory. A second Trump administration will be more coherent and focused than the first. Mr. Trump learned from his experience the first time not to trust experts who were more committed to the institutions of the state than to him. This time around, he will fill his cabinet with loyalists who’ll do his bidding. Then, with only one term (hopefully he rides into the sunset in four years) in which to act, he’ll move quickly.

Americans who voted for Mr. Trump often cited the high cost of living and mortgage rates as the reasons they turned on Democrats. The irony is the economy might get too much of a boost from Mr. Trump, which ultimately exacerbates both. The great American satirist H.L. Mencken once said that “democracy is the theory that the common people know what they want and deserve to get it good and hard.” Americans may in due course find out that adage still holds.

DIVIDEND RECAPITALIZATION

Dividends have traditionally been used as a mechanism to return profits to shareholders. Dividend recapitalizations, however, have little to do with profits, as the funds are sourced from taking on new debt. BCE Inc. is a case study in dividend recapitalization. The company itself receives no benefit from a dividend recapitalization, only the burden of loan payments, and the economy loses any stimulus the capital may have otherwise provided – all at the expense of enriching investors.

In recent years, there has been an increase in dividend recapitalizations, most notably in private equity where these companies are using cash flow (not just profits) to enrich shareholders. This is a worrying trend.

Cash flow is the lifeblood of a business, it’s what a business needs to operate and grow. When overused, dividend recapitalizations can undermine an economy’s long-term growth and productivity. A large proportion of private equity investors in Canada are foreign – mostly American – which means a lot of this cash is not being recirculated in our economy. This does not bode well for Canada.

There is little public information available on dividend recaps, especially in Canada. However, according to Pitchbook, a leading capital markets resource, the U.S. market is expected to have its biggest-ever year for recaps in 2024, surpassing 2021′s all-time annual high of US $76 billion. There is every reason to believe that trends in Canada mirror those of the United States.

Dividend recaps leave companies with less cash available for productive activities such as business operations and capital investments. With less cash available, a company may be forced to slash expenses, lay off employees or declare bankruptcy when faced with unexpected hardship.

The rising trend of dividend recapitalizations may be partly to blame for Canada’s lacklustre economy. Canada has a big productivity problem, which is partly because of a lack of business investment. The country’s business R&D investment in 2019 accounted for only 0.79% of GDP, ranking a measly 26th out of 37 OECD countries.

Corporate investment per worker in the country declined 20% between 2015 and 2021. Canadian companies are not investing as much as they used to. Instead of building growth, companies are increasingly choosing to buy it (through M&A) or forsaking growth to distribute capital back to investors.

Shareholder distributions are also rising among Canadian public companies. While data on private companies is limited, the following public company statistics can provide an illustration – assuming private equity-owned firms distribute cash in a similar fashion – given their shared goal of maximizing investor returns. From the mid-80s until 2014, Canadian public companies distributed approximately 38% of their profits to shareholders and invested approximately 36 % of profits into capital expenditures.

From 2015 to 2022, shareholder distributions increased to approximately 50 % of profits, while capital investment fell to less than 20 %, and then to 10 % in 2020-2022.

Given the capacity of our private markets and limited available information, it’s impossible to know exactly how prevalent dividend recapitalizations are in Canada. But it’s a fact that the practice is rising in the United States, and that Americans are involved in most Canadian private equity deals.

To increase productivity, we need to invest in our businesses, not just cash them out. Policy alone cannot solve the productivity crisis; businesses also need to operate more productively. And we can’t properly discuss improving productivity without addressing unproductive behaviour such as dividend recapitalizations as well as leveraged buyouts and share buybacks.

If we are serious about improving productivity in Canada, we must consider the impact this extractive behaviour is having on our economy, especially when it isn’t even really benefiting that many Canadians.

THE BITCOIN PARADOX

Recently, Sotheby’s auctioned a piece of art that included a frame around a banana duct taped to a wall. The work entitled “comedian” fetched US $6.2 million at auction. The winning bid from Justin Sun a Chinese crypto entrepreneur, came about because he considered it conceptual art, representing “a cultural phenomenon that bridges the worlds of art, memes, and the cryptocurrency community.” For his US $6.2 million investment, Mr. Sun received a “certificate of authenticity” and instructions how to duct tape a banana to a white background and surround it with a frame. In our mind, the purchase represents the unbridled optimism that underpins bitcoin’s surge since the election of Donald Trump.

Since Trump’s election win, Bitcoin has risen from the US $70,000 price point to nearly US $100,000. The rationale for the price surge is Mr. Trump’s positive views on crypto coupled with an influx of crypto currency friendly politicians in the US Senate and the US House of Representatives.

The bitcoin community envisions a future where bitcoin isn’t just a speculative asset but a mainstream medium of exchange. However, the value of bitcoin as a medium of exchange brings to light a fundamental paradox that is tough to reconcile.

A recent paper published in the Journal of Behavioral and Experimental Economics examined what makes bitcoin investors tick. It found that these investors aren’t just financially motivated, they’re driven by a strong desire for financial autonomy and a deep distrust of traditional institutions. They favour meritocratic over welfare-oriented systems.

In other words, they believe in a free-market system where income is distributed based on individual ability with less government intervention, as opposed to a more equitable distribution of wealth facilitated by social programs and policy. In essence, they’re rebels seeking to upend the status quo.

This mindset aligns with bitcoin’s original allure as a decentralized currency free from government control. It’s no surprise that bitcoin-heavy investors differ significantly from traditional stock investors who, comparatively, prioritize stability and are more accustomed to regulatory oversight. They tend to be risk-takers, often exhibiting higher levels of novelty-seeking and even gambling tendencies.

At least some crypto-enthusiasts could just be straight-up anarchists: Dogecoin, a cryptocurrency which was explicitly created as a joke, doubled in value since the election and spiked yet again after Mr. Trump announced a new Department of Government Efficiency (DOGE) would be co-led by Elon Musk. Mr. Musk has a history of cryptic postings about dogecoin on X which are often followed by heavy price fluctuations.

But here’s the paradox: If bitcoin were to become widely used as a currency, it would inevitably require more government regulation. The very decentralization that attracts investors and speculators could lead to financial chaos if left unchecked. Without some form of higher regulation, widespread bitcoin adoption could pose significant risks to financial stability and consumer protection.

But the paradox doesn’t end there. If people believe bitcoin’s value will keep soaring, they have little incentive to spend it. Why use bitcoin to buy a coffee today if it might be worth double tomorrow? This speculative holding reduces bitcoin’s effectiveness as a currency. Currencies need to circulate to facilitate trade and economic activity.

If everyone holds on to their bitcoins, it can’t function as a medium of exchange. So, we’re left with a conundrum. For bitcoin to achieve mainstream adoption, it would need to embrace the very regulations and oversight it was designed to avoid. This clashes directly with the beliefs of its core investors, who value decentralization and freedom from government intervention. Additionally, overcoming the hoarding mentality would require shifts in how investors perceive and use bitcoin.

Bitcoin stands at a crossroads. The very features that make it appealing are the same ones that hinder its ability to function as everyday money.

As individual investors, you can’t ignore these paradoxes when considering bitcoin as part of your investment portfolio. The allure of massive appreciation can be tempting, but it’s important to approach cryptocurrency with caution. Bitcoin’s volatility means its value can swing dramatically in short periods, which can have a significant impact on your financial well-being if you’re overexposed.

Financial advisers often recommend that high-risk assets like bitcoin should make up only a small portion of a diversified portfolio, some going as far to cap their recommendations at 1 % of a portfolio.

Regularly rebalancing your investments also ensures that no single asset class becomes disproportionately large, which could expose you to undue risk. By keeping your bitcoin holdings to a reasonable percentage, you can participate in potential gains while mitigating potential losses.

In the end, whether bitcoin can overcome its inherent paradoxes and evolve into a mainstream currency remains uncertain. Its future needs some sort of balance between the ideals of decentralization and the practicalities of regulation and everyday use.

Richard N Croft

Chief Investment Officer